For years, airline payments sat quietly in the background. They were treated as plumbing – necessary, but not something leadership would spend much time on. That has shifted. Today, payments influence how customers book, how revenue is captured, and even how airlines compete.

A new whitepaper from Edgar, Dunn & Company (EDC) looks at this shift in depth. It argues that payments should be considered a strategic function, not just an operational one and that airlines have much to gain from taking a more deliberate approach.

Payments as more than a cost

Margins in aviation are famously slim and payments have not always had much attention. Yet they make up about 2.2% of airline revenues – more than US$22 billion globally. EDC’s analysis suggests those costs can often be trimmed by 10–20% through better acquiring terms and more active management of payments.

The other side of the story is revenue. Payments affect conversion, market reach, and ultimately customer loyalty. Offering local payment methods, providing installment options, or simply ensuring approval rates stay high have a direct impact on sales. In many cases, airlines leave that value untapped.

Where airlines struggle

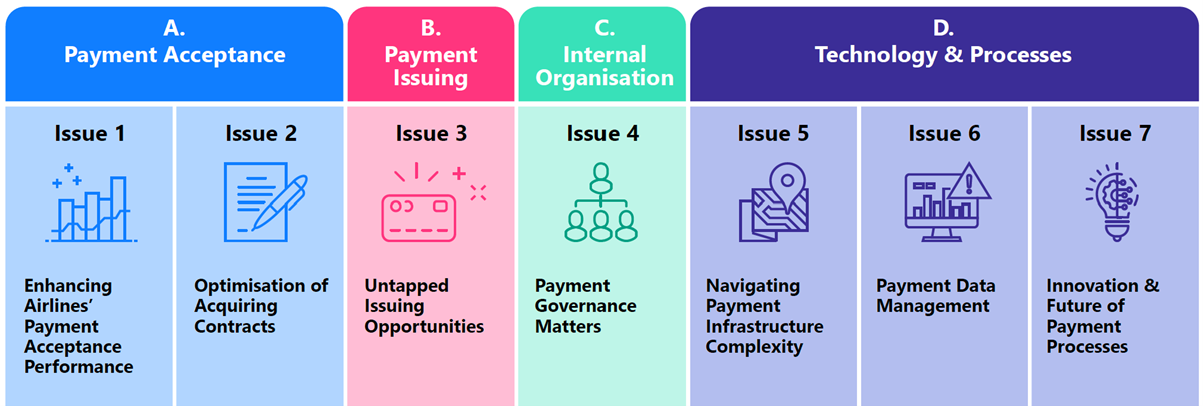

Based on decades of project work, EDC highlights seven key issues and pain points airlines face as highlighted below.

Seven Key Payment Challenges for Airlines

High acceptance costs, often driven by virtual card processing fees or legacy acquiring contracts, are a key issue for airlines. Another is missed opportunities by not supporting the payment methods customers actually prefer. There are also internal issues. In some airlines, no single team owns payments. Infrastructure has grown in silos, making it hard to innovate quickly. And data, while abundant, is often fragmented. Approval rates, fraud levels, and the true cost of acceptance remain opaque. None of these problems are unique to one region or type of carrier, they crop up across the industry.

The changing environment

It is not just internal complexity that makes payments a pressing topic. The external environment is also moving quickly:

- Customer expectations are shifting, with digital wallets, flexible rebooking, and instalment plans becoming standard in many markets.

- Technology innovation has accelerated, from payment orchestration to contactless check-in and in-flight payments.

- Regulation continues to evolve, whether through PSD3 in Europe, Strong Customer Authentication, or central bank digital currencies.

- And on the provider side, new entrants, models and changing acquirer strategies are reshaping the landscape.

The result is that payments can no longer be managed as a static process. They require ongoing monitoring and adjustment.

What airlines are doing

Case studies in the report underline the significant potential impact of payments. One airline discovered its indirect sales approval rates were running at 50-60%, well below the industry benchmark of 80% or more. Another achieved 10-20% savings by renegotiating acquiring contracts with local providers.

Some carriers are also moving into issuing. AirAsia has embedded a digital wallet into its “super app,” which has supported both refunds and ancillary sales. GOL in Brazil has built co-branded credit card partnerships with several banks, widening reach and boosting loyalty. And Air France-KLM recently worked with Nium on a virtual card solution for B2B payments, cutting costs and easing reconciliation.

These examples suggest payments can do more than trim costs. They can help strengthen loyalty, open new revenue streams, and improve resilience.

The role of governance

One of the clearest messages from the whitepaper is the importance of governance. When no one “owns” payments inside the organisation, projects move slowly and opportunities are missed. Airlines that have introduced a dedicated Head of Payments, backed by a cross-functional governance committee, have seen faster rollouts and better alignment between commercial teams and IT.

Looking ahead

The industry is moving towards modern retailing models such as NDC and Offers & Orders. Payments will be a central part of that transition. Orchestration, stronger data management, and closer links with loyalty schemes are all likely to become standard.

For airlines preparing for 5.2 billion passengers in 2025, even small improvements in payment conversion or cost efficiency matter. A single percentage point can translate into millions of dollars. Payments are no longer background plumbing. They are part of the storefront and Edgar, Dunn & Company would be pleased to assist you capturing all the opportunities related to payments.

Download the full report here: From Plumbing to Storefront: How “Payments” is Changing for Airlines

About Edgar, Dunn & Company

Founded in 1978, Edgar, Dunn & Company (EDC) is an independent global payments consultancy, advising clients in more than 45 markets each year. EDC’s Travel Payments Practice, established in 2002, works closely with airlines, hotels, OTAs, and payment providers worldwide to design and implement strategies that optimise payments across cost, revenue, and customer experience.