Why travelers expect new ways to pay

Admit it, you’ve never really loved paying for travel.

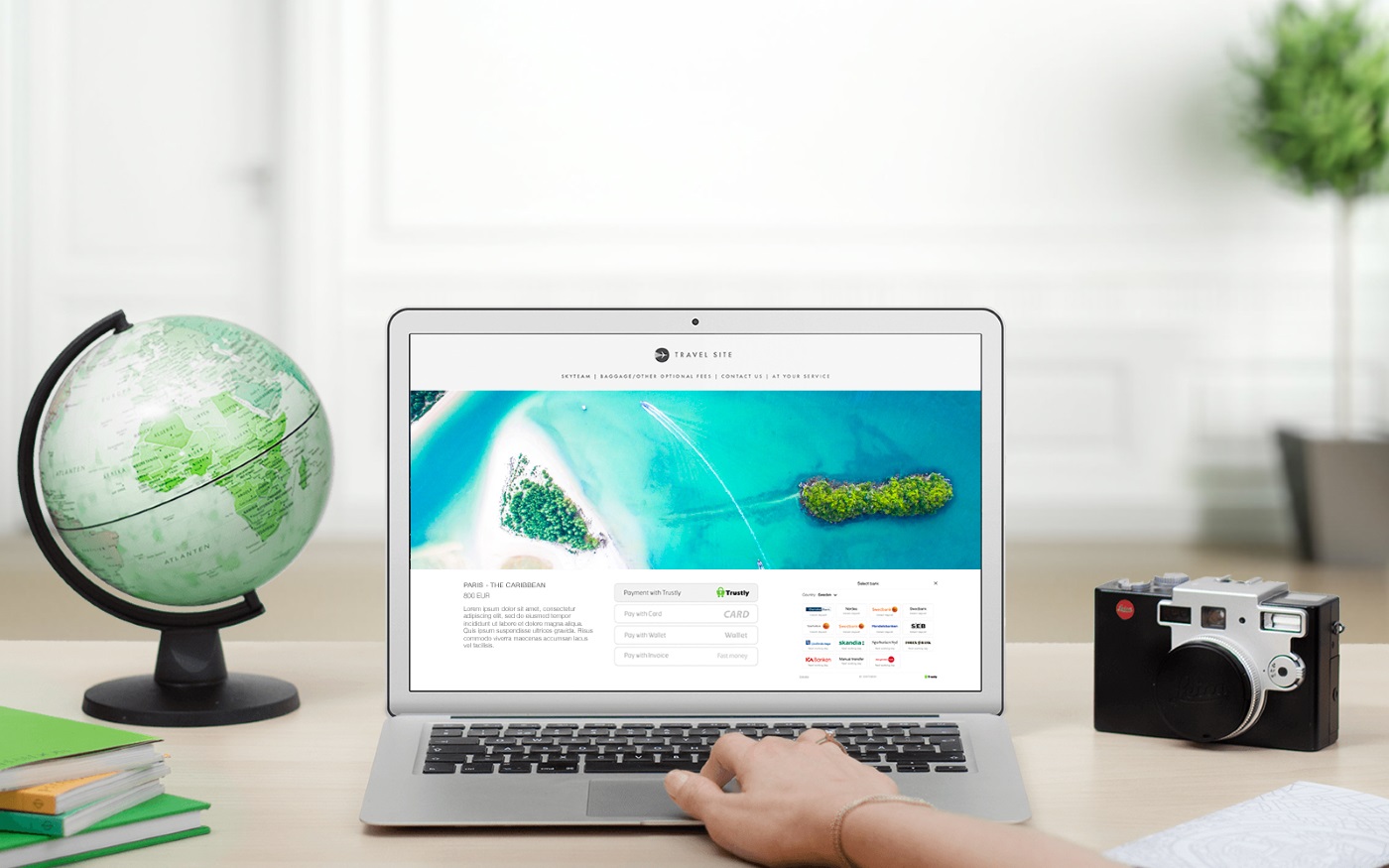

If you’ve bought a flight or rented a hotel room this century, you’ve probably noticed a clunky and archaic payment experience. That’s because credit cards have long been one of the few ways you could pay for travel.

Consumers want payment choices

That’s changing now though. Airline passengers and hotel guests are fed up with paying the same old way, according to new Trustly research. Our survey shows 71% want more than card payments at the checkout.

Our survey also found that 31% of travelers will actually abandon a purchase because of a lack of payment options.

If that figure startles you, it should. It’s a reminder you need to give consumers a frictionless and flexible way to pay across the customer journey.

Across the payments landscape, companies have taken notice. Ovum’s 2018 Global Payments Insights Survey highlights how personalisation and ‘invisible payments’ will be key areas of focus for merchants, billing companies, and retail banks. In fact, more than 75% of organisations surveyed told Ovum they’re already earning customer service wins through real-time payments.

Millennials expect better experiences

So, which consumers are driving this shift? You guessed it, it has a lot to do with millennials. The Pew Research Center defines millennials as anyone born between 1981 and 1996. Now the world’s largest demographic, millennials are an economic powerhouse.

New Research: The New Way to Pay

Strapline: Why the travel industry needs TO THINK BEYOND CARDS

Tellingly, they’re digital natives. So it makes sense that their expectations as digital consumers are high. How travel merchants design and personalise services and products can shape millennial purchasing decisions – often in the blink of an eye.

Just look at the findings of the 2019 Travel Trends and Expectations report

from Mastercard and Wex, for example. It highlighted that millennial and Gen Z travellers are three times more likely than Boomers to let AI plan a trip using their past travel data.

In fear of payment fraud

But just because consumers want more ways to pay and more personalised experiences, that doesn’t security and fraud concerns go away.

“Implementing alternative payment methods – simply providing consumers with more options – is not the same as more choice.” — Mike Parkinson, Trustly’s UK General Manager and Director of Travel.

High profile data breaches and well-publicized cyber-attacks have damaged trust. Consumers are more savvy about sharing their financial information with multiple businesses. It’s led to a rise in more complex authentication and identity verification processes – some of which have hurt consumers’ overall buyer experience.

More than half of merchants in that same Ovum survey say concerns over the risk of a data breach have limited their investment in customer experience.

“Without a doubt, it can be a complex and technically challenging endeavor, especially for those in the travel and aviation sector using legacy systems built on rules from decades ago,” says Mike Parkinson, Trustly’s UK General Manager and Director of Travel.

So travel merchants face a twofold challenge: balance consumers’ growing desire for payment flexibility and personalisation with data security. It’s not going to be easy.