by Elsie Clark | Jan 7, 2026 | Airlines, News, Retailing

Lufthansa Group have selected Amadeus Nevio modular solutions as partners for its retail modernisation strategy.

Through the new technology, the Group’s nine airlines — which include Austrian Airlines, Eurowings, and Swiss — will be able to upgrade their retail offering at their own pace. Ultimately, the partnership with Amadeus will enable the airlines to provide passengers with personalised offers.

Developed in line with IATA’s Order standard, Amadeus Order Management will make it easy for travellers to purchase flights and ancillaries in one order. Amadeus Product Catalogue and Stock Keeper will further boost to Lufthansa Group’s proposition, offering a comprehensive overview of stock availability.

Tamur Goudarzi Pour, Executive Vice President Strategy at the Lufthansa Group. said:

The Lufthansa Group is the pioneer in modern airline retailing. We are excited to partner with Amadeus to advance the development and implementation of an innovative order technology and to further improve the travel experience for our customers.

Additionally, the Group will become the first airline group to incorporate Amadeus Delivery Management. Capabilities such as a digital journey pass and fulfilment tracking will bolster personalisation services while enhancing support during disruption.

Decius Valmorbida, President of Travel, Amadeus added:

Lufthansa Group and Amadeus share a long track record of collaboration that has been instrumental in shaping airline technology. We’re excited for the next phase of this relationship, which is our largest Nevio engagement to date, with a focus on modern airline retailing.

The planned development of Amadeus Delivery Management marks an industry first, especially for servicing across the Group, representing a promising step toward more seamless, end-to-end travel experiences. With Amadeus Nevio’s open, modular approach, we aim to deliver exactly what Lufthansa Group needs to transform.

Join us at World Aviation Festival 2026 to discuss the future of airline retailing.

For more like this, see:

by WAF_Contributor | Jan 5, 2026 | Airlines, Features, Retailing

By Daniel Friedli, Travel in Motion AG

When the Modern Airline Retailing (MAR) programme kicked off in earnest around 2022, it did so with a mix of scepticism, excitement and ambition. Airlines had spent a decade talking about transformation while wrestling with legacy plumbing that persists. The buzz and hype have turned into activity, and progress since then has been unmistakable. Volumes of NDC transactions grew, more carriers began experimenting with Orders and vendors retooled roadmaps. With the creation of the Airline Retailing Consortium and the countless hours airlines, vendors, the International Air Transport Association (IATA) and consultancies put into it, the foundations were laid.

As 2026 comes into view, one should not expect a revolution but rather an evolution of deliberate, confident steps. The industry is moving from “proving the concept” to “making it normal”. Below are the areas where that should be most visible.

Airlines: Pragmatism with visible results

Airlines in 2026 are not chasing transformation for the sake of transformation. They are chasing bottom-line improvements, operational predictability and competitive differentiation.

Expect more airlines to announce concrete MAR milestones: full Order pilots in selected channels, retirement of niche legacy flows or live continuous pricing in indirect markets through NDC. Carriers with strong digital DNA and a clear executive-set focus will move faster, but even traditionally conservative players will take meaningful steps driven partly by vendor capability finally catching up, fear of missing out and seeing their partners and competitors making the move. Other factors which will drive decision timelines are expiring passenger service system (PSS) contracts, opportunities to break free from vendor lock-ins and new commercial opportunities.

We will also see airlines get bolder with product differentiation. Rich media, personalised bundles, post-purchase upsell flows and dynamically-created ancillaries will expand as the offer and order management and related systems increase in maturity and reliability. What was previously “demo-ware” will turn into everyday retailing.

Finally, airlines are realising they must treat MAR as an enterprise project with corporate-driven roadmaps, not merely a distribution or technology initiative. We can expect organisational rewiring: commercial, digital, operations and finance working against a coordinated roadmap.

Industry: From advocacy to alignment

The broader ecosystem enters 2026 with more clarity on its role.

Travel in Motion (TiM) believes that IATA’s job should increasingly shift from evangelising to enabling. Standards stabilisation (and please, acceleration), governance frameworks, removing regulatory hurdles and settlement evolution should be core focus areas. We expect progress on interline Order capabilities and clarity on product definition and data alignment.

We expect the Airlines Reporting Corporation (ARC) and the Airline Tariff Publishing Company (ATPCO) to keep nudging the industry towards practical adoption. ARC will optimally expand Order-based settlement pilots, while ATPCO refines the bridge between fare filing and dynamic offer construction, providing structure without stifling innovation.

Meanwhile, airports, travel management companies (TMCs) and global distribution systems (GDSs) must be involved more by the airlines, IATA and the consortium to deepen their integration efforts. Without the buy-in of these key ecosystem players, even the best intended transformation plans will not be executed. Airports must focus on making Order data usable for operational planning with the support of the airport software vendors which usually provide a legacy departure control system (DCS). Furthermore, together with airlines, regulators and tech companies, the use of data and biometrics should be expanded to move towards streamlined airport operations which allow customers to have more dwell time for shopping, dining, working or socialising. The innovative TMCs we should see building richer servicing and duty-of-care flows on top of Orders rather than fighting them. GDSs, already repositioning as multi-source aggregators, will continue modernising back-office processes to handle Orders natively.

Technology: The quiet enabler

Technology’s role in MAR in 2026 will not invent new buzzwords but rather focus on three practical themes: simplification, decoupling and automation.

The decoupling of Offers and Orders will continue to mature. In 2026, expect more airlines and vendors to treat the order management system (OMS) as the new “gravitational centre” of retailing. While not fully independent from the PSS, we should see capability of orchestrating fulfilment, servicing and settlement events across partners. The shift will not be large-scale globally just yet, but pilots will start turning into production-grade rollouts.

Even more exciting is when application programming interface (API) performance and reliability finally become boring. This is good. Airlines that struggled to stabilise NDC APIs in earlier years are now working with vendors to mature and further standardise additional APIs. Vendors are starting to expose more granular services and deploying event-driven architectures which enable better accessibility as well as more automation built by airlines.

We can already see that artificial intelligence (AI) will stop being a sideshow. TiM expects genuine use cases to help airlines tackle tedious daily tasks, helpers to drive additional revenue or intelligence to orchestrate smart customer experience flows. Other examples we may see, aside from flashy prototypes, are automated quality checks on offer construction, anomaly detection in servicing flows or proactive failure alerts for interline Orders. AI will become a mainstay and serve as a tool in the toolbox of offer creation, order management and customer experience.

We believe technology in 2026 is not about breakthroughs; it is about making the plumbing trustworthy enough that commercial teams can implement new features and capabilities with confidence.

Vendors: Convergence and clarity

The vendor landscape has spent the last few years in a curious state of both innovation and identity crisis. In 2026, this stabilises and vendors will have defined more clearly in which space they play across the digital retailing ecosystem.

We expect clearer segmentation. The large PSS providers will double down on refining their hybrid models, supporting legacy EDIFACT and legacy system compatibility while offering progressively stronger and, we hope, modular solutions. Mid-tier tech firms that have been in the airline space for a while, and those that more recently entered with enthusiasm will either consolidate or specialise: offer optimisation, segmentation, merchandising via product catalogue and stock keeper, order orchestration microservices, integrations for interline and codeshare and so on. From TiM’s perspective, we hope to see a few examples of true modularity, and one or two bold purchasing decisions where some of the underdogs get a true chance to shine.

Crucially, vendors will be far more transparent about timelines and capabilities, and they will have to be – now it is about commitment and not selling a dream. After years of marketing roadmaps that overshot reality, 2026 brings a more grounded tone. Airlines will push for and get firmer delivery commitments, better transition planning and more standardised interfaces that reduce custom build cycles.

Another shift, and perhaps an overshoot of optimism on our part: integration costs go down, not because the work is easier, but because more vendors align on IATA schemas, adopt shared tooling, utilise AI helpers and participate in joint reference implementations. Interoperability becomes less aspirational and more contractual.

In 2026, Modern Airline Retailing will not “arrive”, but it will become more of a reality for many airlines. Incremental value will be generated by early adopters of initial modules; the legacy systems will have to loosen their grip. The ecosystem, while still in a hybrid mode this year and for several years to come, starts benefiting from the removal of legacy concepts and the use of modern architecture and technology. Progress will be uneven but unmistakably forward.

If the past four years were about proving the value of MAR, 2026 is the year the industry starts extracting that value. Perhaps not yet at scale, but steady drops also fill a bucket.

Join us at Aviation Festival Asia 2026 to discuss the future of modern airline retailing.

For more from Travel in Motion, see:

by Elsie Clark | Jan 5, 2026 | Airlines, News, Retailing

KM Malta Airlines have announced a new partnership with CarTrawler to offer ancillary car rental booking directly through their website.

CarTrawler’s cloud-based Connect platform seamlessly links customers to more than 1,700 car rental providers in 50,000 locations around the world. Passengers who book through the service also benefit from no booking fees, round-the-clock customer support, and flexible cancellation terms.

The Maltese national carrier was established in 2024 after its predecessor, Air Malta, dissolved under financial pressures. Boasting the newest aircraft fleet in Europe, the airline was ranked the fourth-best regional carrier in Europe by Skytrax in 2025.

To drive financial stability and customer satisfaction, KM Malta Airlines has embarked on a modernisation strategy that also saw it launch KM Malta Holidays in October 2025. The package holiday offering allows travellers to book hotels, flights, and extras in one place. The partnership with CarTrawler will consolidate this ancillary arm while driving greater revenue.

CarTrawler already boasts a range of partners in the aviation sector, with Ryanair joining the roster in December 2025. Eddie Wilson, CEO Ryanair DAC, commented:

CarTrawler delivers great value with an outstanding range of car rental options at competitive prices, fully integrated into the Ryanair booking journey. Ryanair passengers already enjoy the lowest fares in Europe and this new product will offer them the best value with our price match guarantee.

Peter O’Donavan, CEO CarTrawler, told World Aviation Festival in October:

Our proposition is developed from the ground up with B2B in mind, allowing us to deliver customised solutions to our airline partners. So the fact that our platform can adapt and adapt in a very scalable way is why we continue to win and retain new business.

Join us at World Aviation Festival 2026 to discuss the future of ancillary retail in aviation.

For more like this, see:

by Elsie Clark | Dec 17, 2025 | Airlines, Airports, Digital Transformation, News, Payments, Retailing, Travel Tech

The aviation industry in Asia is moving faster than ever, driven by cutting-edge technology, bold collaborations, and a deep commitment to sustainable growth. The Aviation Festival Asia Awards 2026 are here to celebrate the organisations and initiatives that are redefining what’s possible in the region.

We invite you to recognise the organisations that have truly excelled this year across operations, customer experience, and digital transformation.

Award Categories

- Sustainability Achievement Award: Recognizing outstanding commitment to environmental responsibility and sustainable practices in aviation.

- Best Use of AI: Honouring exceptional application of artificial intelligence to improve operations, efficiency, or passenger experience.

- Collaboration of the Year (Airline/airport/ground handlers only): Celebrating a successful partnership between airlines or between an airline and an airport that delivered measurable innovation or impact.

- Industry Game-Changer: Awarded to an airline that has redefined norms, challenged conventions, and driven transformative change within the industry.

- Smart Airport Journey Award: Recognizing an airport that has significantly enhanced the passenger journey through innovative technology solutions.

- Digital Innovator of the Year: Awarded to a company, team, or initiative that demonstrated visionary use of digital tools or platforms to reshape airline or airport operations, customer experience, or service delivery.

Submit your nominations here!

Key Submission Details

Submissions are based on individual organisations and their groundbreaking achievements. While the award is for the company/organisation, we encourage you to mention individual people or teams in your submission if it helps illustrate the achievement; this will help us in reaching out to potential finalists.

The deadline for all submissions is Monday, Jan 19th.

Please note: To officially accept and receive an award at the ceremony during Aviation Festival Asia (March 25 – 26, 2026, Singapore), a representative from the winning organisation must be registered to attend the event

Submit your nominations here!

We can’t wait to recognise the achievements of the industry in Singapore!

Our Battle of the Airline Apps Asia competition is also open for submissions. This separate award honours the best in airline technology, customer service, and operational excellence. Be sure to vote for your favourite today!

by Elsie Clark | Dec 11, 2025 | Airlines, News, Retailing

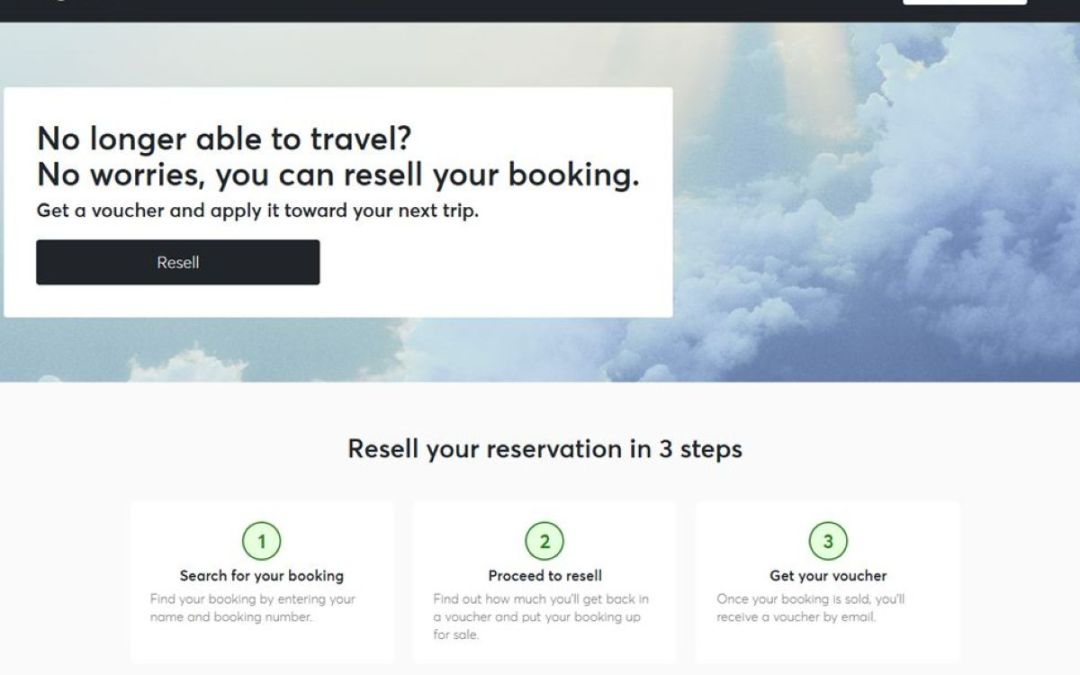

Canadian low-cost carrier (LCC) Flair Airlines is set to launch a ticket resale service, the first of its kind in North American aviation.

The platform is powered by French startup Fairlyne, who already partner with Royal Air Maroc and Transavia on similar services. Through their technology, passengers holding non-refundable tickets can sell them to another passenger and receive a Flair voucher in exchange.

Maciej Wilk, CEO of Flair Airlines, said:

This service is about giving passengers a better experience — even when they can’t travel. It’s a smart solution that offers more flexibility while optimising our operations.

The initiative is part of the LCC’s Flair FWD strategy, which aims to strengthen Flair’s position in the Canadian market while consolidating its reputation for fair, fuss-free travel. Other strategies launched under the Flair FWD banner include AI-enhanced omnichannel customer communications, and the package holiday service Flair Vacations.

Presenting the project as a ‘win-win’ for passengers and the airline, the resale platform will launch in the coming weeks. Gilles de Richemond, CEO of Fairlyne, commented:

We’re helping airlines introduce a new level of customer service and flexibility, while maintaining complete control. It’s a customer-first approach that addresses a long-standing frustration.

Join us at Aviation Festival Americas 2026, where Flair CEO Maciej Wilk will be on-stage for an exclusive keynote interview and CEO panel.

For more like this, see:

by Elsie Clark | Dec 10, 2025 | Airlines, Digital Transformation, News, Retailing

Air Serbia has partnered with Loyalty Juggernaut to overhaul its loyalty programme.

The Serbian national carrier has set March 2026 as the launch data for its revamped loyalty offering. Loyalty Juggernaut’s AI-powered Gravty platform will provide the infrastructure to maximise customer engagement. Snezana Radinovic, Frequent Flyer Product Development Manager at Air Serbia, said:

Our ambition is to create one of the most engaging loyalty propositions in Europe.

Specific details of the scheme, such as rewards and partners, are currently unknown. Loyalty Juggernaut’s technology underpins many airlines’ cutting-edge loyalty offerings, including Emirates Skywards and new airline Riyadh Air’s Sfeer. Based on these examples, Air Serbia frequent flyers can expect to benefit from personalised offers and upgrades, as well as the opportunity to spend points on ancillaries such as car rental and hotels.

Jiří Marek, CEO of Air Serbia, added:

This partnership marks a key step in transforming how we engage with passengers. We are building a modern loyalty ecosystem that rewards customers for every interaction with Air Serbia. By combining our service excellence with LJ’s technology, we will deliver a program that reflects today’s travellers: connected, mobile, and seeking personalised value.

Air Serbia will celebrate 100 years of operations in 2027, and the carrier has set an ambitious new strategy to mark its centenary. Carrying 4.4 million passengers a year, the airline has added 50 new destinations in the past four years, including launching a new long-haul route to Toronto. Marek has described an airline as ‘a natural ambassador of its home country’. Through its partnership with Loyalty Juggernaut, Air Serbia will hope to strengthen its image and boost connectivity to the Balkans.

Join us at World Aviation Festival 2026 to discuss the evolution of loyalty programmes.

For more like this, see:

by Elsie Clark | Dec 9, 2025 | Airlines, News, Retailing

It’s been one of the biggest trends in travel over the past few years: neighbour-free booking. Airlines are waking up to the possibility of monetising seats that might otherwise have gone unsold, all while providing passengers with greater comfort and an improved onboard experience.

From Wizz Air’s Wizz Class to Emirates’ neighbour free add-ons, this retail offering is rapidly becoming the norm. Ross Vinograd, General Manager – Seating at Plusgrade, sat down for an exclusive interview to tell us more.

Today., empty seats are being randomly assigned by the airline. Airlines need to stop handing these out willy-nilly and start giving passengers what they want, which is the best experience in economy full-stop — flying neighbour-free.

On a typical 200-seat aircraft, on average around 32 seats go empty. This represents a significant lost opportunity for airlines to maximise their revenue: at very little extra cost, they could be selling these empty seats to passengers who want their flight to feel that little more luxurious without breaking the bank.

For a lot of folks, the opportunity to bid for business may be out of their reach. But sitting in the back with an entire row to yourself is still pretty amazing.

Vinograd also believes neighbour-free booking can enhance loyalty programmes. Passengers can pay to reserve the row for themselves using points, or the neighbour-free option can be offered as a reward. Research from Plusgrade has found that neighbour-free seats deliver four times the NPS score of a seat with extra legroom, offering a real opportunity for airlines to delight customers.

This seat is something that didn’t sell retail. It’s going to fly empty anyway, so you might as well monetise it.

Through integration with ancillary platforms, passengers can bid for an empty seat, so that airlines can still sell to another passenger if the flight is in high demand. This way, travellers don’t spend their money on extras they don’t receive, and the airline retains the ability to fill a flight as needed.

🎥 Watch the interview to hear Ross Vinograd’s full thoughts on turning empty seats into a retail opportunity.

- What do you think are the main missed opportunities in ancillary sales? Are there any easy wins for airlines and airports to increase revenue?

- How does an airline both generate revenue from what was an empty/unsold seat AND keep all its passengers, including loyalty program members, happy?

- How can airlines make an empty seat, especially a middle seat, at the back of the aircraft (ie, economy cabin) something to be desired?

- Looking ahead, what do you think will be the next ‘affordable luxury’? How are customer habits changing?

Join us at Aviation Festival Americas 2026 to discuss the future of airline retail.

For more like this, see:

by Elsie Clark | Dec 5, 2025 | Airlines, News, Retailing

Scandinavian Airlines (SAS) have launched SAS Holidays, a new product that will enable travellers to book their entire trip in one place.

Seamlessly blending flight booking, car rental, hotel stays, and personalised extras, SAS Holidays consolidates the airline’s position in a rapidly evolving travel ecosystem, muscling in on competitors such as Booking.com and Jet2.

Aron Backström, VP Product & Loyalty at SAS, said:

By offering quality-assured packages, EuroBonus benefits and competitive prices, we create new value for our travellers and new growth opportunities for SAS. SAS Holidays represents a natural next step in our ambition to be the first choice for both flights and holidays.

The scheme is marketed with the tagline, ‘There’s holidays. And there’s SAS Holidays’. Passengers who book a trip through SAS Holidays will earn loyalty points (EuroBonus) with every purchase in their package. Existing members will benefit from their usual tier rewards when booking a holiday through SAS.

Covering almost every destination in the SAS Network, the new travel offering gives passengers across Europe the opportunity to personalise their journey. SAS Holidays was developed in collaboration with TripX Travel AB, who will curate unique hotel stays for SAS customers.

In a statement on LinkedIn, SAS President and CEO Anko van der Werff added:

SAS has always been about connecting people. With SAS Holidays, we’re taking that a step further – bringing convenience, quality, and the Scandinavian reliability people associate with SAS to the entire holiday experience.

I’ve seen how much our customers value simplicity and trust. SAS Holidays delivers both – making travel effortless and joyful.

Join us at World Aviation Festival 2026 to discuss the evolution of airline retail.

For more like this, see:

by Elsie Clark | Dec 4, 2025 | Airlines, Interviews, Retailing

Flying Blue was named point.me’s best airline loyalty programme for the second year running in 2025. But what’s the secret to Air France-KLM’s ongoing success?

Ben Lipsey, SVP Loyalty, Data, and Digital at Air France-KLM, shares his insights in an exclusive interview from World Aviation Festival 2025. With around two-thirds of its customers based in Europe, but half its revenue coming from the US, Flying Blue must strike a careful balance to stay relevant with both demographics.

I think we got the recognition from point.me for being an easily available currency, the flexibility we offer, and the attractiveness of our rewards. That allows us to offer a programme that is relevant to both Europeans and Americans.

Maintaining that relevance is something Lipsey believes will be critical moving forward, as personalised offers become commonplace. Consumers are increasingly likely to tune out if they are presented with products that aren’t tailored to their lifestyle. From a loyalty perspective, personalisation could be the difference between a traveller sticking with one airline or switching to a rival.

We need to make sure that we use the knowledge we have about a customer to remain ahead of the game, so we can better target them for the right offers.

As well as balancing the fine line between attractive rewards and revenue management, Lipsey discusses the relationship between sustainability and loyalty. Although ‘frequent flyer’ status carrying pejorative environmental connotations, Lipsey sees it as an opportunity to consolidate sustainable behaviour and advance sustainable aviation fuel (SAF).

We try to reward our customers for joining us on our sustainability journey by earning points through buying SAF flights. We are the first airline loyalty programme to offer this.

With Lipsey’s role covering data and digital as well as loyalty, we also discuss the overlap between these areas and how to bridge data insights with the physical experience of flying.

We want to tie all this together to make sure we’re offering an app that is top of the market, a website that makes things easy, pushing offers that are relevant, so that when customers choose to engage with use, they know we’re giving them the best possible experience.

🎥 Watch the interview to get the full discussion on loyalty with Ben Lipsey.

Questions asked include:

- Point.me recently rated Air France-KLM’s loyalty programme, Flying Blue, as the best in the world. Why do you think that is, what kind of initiatives have helped you stand out and deliver high customer satisfaction?

- How are customer attitudes to loyalty changing? And how do airlines need to adapt?

- How can airlines make sure they’re giving passengers the best loyalty points for their money?

- How can loyalty programmes integrate sustainability with loyalty to attract more customers while staying in line with net-zero targets?

Join us at World Aviation Festival 2026, where our dedicated panels, workshops, and presentations will be analysing how airlines can boost loyalty and rewards programmes.

For more like this, see:

by Elsie Clark | Dec 3, 2025 | Airports, News, Retailing

Avinor, Norway’s state-owned airport operator, have partnered with Alphacomm to offer travellers eSIMs.

eSIMs will now be available for purchase on Avinor’s website, making connectivity abroad easier and more convenient for Norwegians and international visitors. Jørn Korbi, VP Digital Commercialisation at Avinor, said:

Our partnership with Alphacomm aligns perfectly with our digital strategy to deliver functional and relevant services that truly benefit our travellers. With this collaboration, we’re giving travellers a convenient opportunity to save on data usage when travelling intercontinentally.

Avinor owns and operates 43 airports across Norway, including the country’s main gateway in Oslo. Handling more than 51 million passengers, the partnership with Alphacomm opens up eSIM use to a significant global market.

eSIMs eliminate the need for travellers to purchase physical SIM cards when travelling abroad. Customers can simply enable the eSIM for the country of their choice on their phone, and connect as normal at their destination. Alphacomm’s eSIM network offers connectivity in over 200 countries through partnerships with more than 1,000 mobile networks. Alongside AI-powered fraud protection, users benefit from flexible data packages and multilingual support.

Sjoerd Groot, Chief Growth Officer, Alphacomm, commented:

This partnership with Avinor demonstrates how travel connectivity should work: instant, secure and hassle-free. By combining our expertise in digital goods with Avinor’s trusted platform, we’re empowering travellers to stay connected globally without the usual complexity or cost. It’s about removing barriers and refining the journey from start to finish.

Join us at World Aviation Festival 2026 to discuss the role of eSIMs as an ancillary product in aviation.

For more like this, see:

by Elsie Clark | Dec 2, 2025 | Airlines, Interviews, Retailing

The limitations of PSS technology continue to inhibit airlines’ profit margins. But new technological solutions have emerged to break the deadlock, helping the aviation industry increase profit margins while improving revenue management.

To learn more about this transformation, we spoke to Surain Adyanthaya, President Travel at PROS. He explains that the emergence of intelligent pricing is not just desirable for airlines, but consumers too.

With dynamic pricing, you have a more continuous pricing sale and you can offer exactly the price that a traveller may want. So the traveller can get a better deal and a more relevant offer.

Airlines have been left behind by changing consumer expectations, shaped by the emergence of e-commerce businesses such as Amazon. They expect quick, personalised offers, and if they don’t receive one they’ll move on to another retailer.

Consumers expect the seller to know something about them, so the products that are offered are things that they are truly interested in. So it’s a very different mindset that the airline needs to adapt to.

Key to this transition is the development of an Offer-Order ecosystem. Adyanthaya concludes by offering advice to airlines wishing to execute this transition successfully.

The challenges airlines face are really antiquated infrastructure and architecture. Rebuilding this is incredibly important to allow the airlines to behave like a modern retailer.

🎥 Watch the interview to hear Surain Adyanthaya’s full discussion on airline’s retail transformation.

- How has consumer behaviour shifted in recent years? What are the current big trends influencing pricing and spending in aviation?

- What about tariffs? Have they had as negative an impact as predicted? What other changes has that policy produced?

- In terms of dynamic pricing, what kind of progress have we seen on this? Has there been any pushback from customers?

- When creating a modern, personalised sales ecosystem, what kind of foundations need to be in place?

Join us at Aviation Festival Asia 2026 to discuss the evolution of retail strategy in aviation.

For more like this, see:

by Elsie Clark | Nov 27, 2025 | Airlines, Interviews, Retailing

The aviation industry remains one of the last industries that hasn’t modernised the way it sells its products. Outdated legacy technology, including PSS, continues to dominate airline retail — but that’s beginning to change.

Alex Mans, Founder and CEO of FLYR, sat down with us at World Aviation Festival to discuss this transformation, and how Offer-Order will rejuvenate the airline retail landscape. In a field that remains highly competitive, he sees retail as an overlooked tool for consolidation.

Airlines need to build a deep relationship with their customers through loyalty. The way you do that is by moving from a commodity to a utility, by being there for them and making it easy to buy and to service.

As well as boosting relationships with travellers, pivoting to a modern retail strategy could also help airlines unlock more revenue. Profit margins remains slim for the world’s carriers compared to travel tech juggernauts such as Booking.com. But Mans sees no reason why the aviation industry can’t build similar success in-house.

The economic impact of modern retailing is that you can sell better and sell more to travellers. You can suddenly buy your flight, your hotel, your car rental, your railway connection, your insurance, through the airline seamlessly in one place.

Some airlines have already begun this pivot to Offer-Order retailing. One of FLYR’s flagship partnerships is with new carrier Riyadh Air, the world’s first digital-native airline. Working to build infrastructure from the ground up represented an exciting opportunity for FLYR to reimagine retailing.

Riyadh Air is the shining beacon of what everybody wants to become at some point in the future, and there will be other airlines announced soon that are on a PSS and are transitioning to FLYR.

Mans concludes by offering some advice to airlines at the beginning of their Offer-Order journey:

We strongly recommend to take a hybrid approach where you start deploying in parallel and migrate over time, effectively. You can unlock incremental revenue, incremental margins, and have that pay for the complete transition journey thereafter.

🎥 Watch the interview to hear Alex Mans’ full thoughts on the airline retail transformation.

Questions asked include:

- What kind of challenges do airlines encounter when relying on legacy systems?

- What is the magnitude of economic opportunity modern retail unlocks for airlines?

- How is it that the FLYR and Riyadh Air launch has moved so quickly?

- How should airlines who aren’t starting from scratch and need to contend with migrating from a PSS think about moving to Offer and Order?

Join us at Aviation Festival Asia 2026 to discuss the future of modern airline retailing in APAC and MENA.

For more like this, see:

by Elsie Clark | Nov 20, 2025 | Airlines, Interviews, Retailing

Powering around 70 airlines and 200 travel brands, CarTrawler is one of the world’s leading B2B mobility solutions providers. Boasting partners from all four corners of the world, including American Airlines, Jet2, and Qantas, CarTrawler’s mission is to get airlines closer to their customers through car rental.

In an exclusive interview, CEO Peter O’Donovan reveals what gives CarTrawler an edge in the market and how he sees their position in the travel industry moving forward. Key to the company’s proposition is their proprietary platform that gives customers access to car rental in over 50,000 locations.

We have a really advanced machine learning-based revenue management platform that adapts prices in real time to optimise revenue outcomes.

O’Donovan also sees car rental as critical to evolving airline loyalty programmes. American Airlines AAdvantage and and United’s MileagePlus are among CarTrawler’s loyalty partners, with customers able to put points towards car rental.

That allows customers to get value from the loyalty points they generate, so they don’t just sit on a card somewhere. And that investment in loyalty is very productive for us and very powerful for airline marketers.

Insurance tech company Koala was recently acquired by CarTrawler, offering a significant opportunity for the company to upgrade its offering. Through Koala, CarTrawler partners add products such as cancel for any reason to booking flows. This focus on delivering value to partners is what O’Donovan believes makes the company stand out in a competitive market.

Our proposition is developed from the ground up with B2B in mind, allowing us to deliver customised solutions to our airline partners. So the fact that our platform can adapt and adapt in a very scalable way is why we continue to win and retain new business.

Looking at the future of the travel industry, O’Donovan predicts that premiumisation and personalisation will continue to be transformative trends. In technology, he sees AI as another tool that could be used to push CarTrawler’s advantage.

We are exploring and delivering solutions through generative AI, be that agentic solutions or large language models. There’s lots of opportunity in what is a very fast emerging and dynamic space.

🎥 Watch the interview to hear Peter O’Donovan’s full thoughts on car rental, airline ancillaries, and the B2B market.

Questions asked include:

- CarTrawler recently acquired the insurtech company Koala. How does this acquisition enhance your partner-first strategy and expand the value you deliver across the travel ecosystem?

- How does your pure B2B model give you an edge?

- How has your loyalty proposition evolved?

- As Chief Executive of CarTrawler, what do you see as the biggest risk and opportunity for the travel industry for 2026?

Join us at World Aviation Festival 2025 to discuss the future of modern airline retailing.

For more like this, see:

by Elsie Clark | Nov 19, 2025 | Airlines, Digital Transformation, News, Retailing

Google is working on adding hotel and flight booking to its AI Mode. Through agentic search, the company expects that users will be able plan and book trips without visiting any web pages.

In a blog post, Google said:

We’re working with industry partners to build an experience where you can simply describe what you’re looking for to compare different flights or hotels and browse helpful information like schedules, prices, room photos, amenities and reviews. You’ll be able to follow up and refine your options, and then once you’re ready, you can quickly complete the booking with the partner of your choice.

This announcement comes two weeks after Google AI Mode added agentic booking for restaurants, events, and beauty appointments in the US. No timeline has been given for the travel booking rollout. Julie Farago, vice president of engineering for travel and local search, told PhocusWire:

We’re not going to rush this out the door because we want to make sure that it’s a seamless experience and that people have all the control that they need and expect.

AI Mode already offers users several features tailored for travel. In the US, Google Canvas can help draft itineraries and make recommendations. Google also announced that their AI-powered Flight Deals tool would be rolled out worldwide, another platform that can help users find the best flight deals through conversation prompts.

The AI booking race is on

Earlier this year saw OpenAI launch Atlas, its ChatGPT search engine. Direct travel booking capabilities are currently being tested by premium users of the platform in partnership with Expedia and Booking.com.

Meanwhile, Perplexity have collaborated with SelfBook to offer native travel booking through its AI.

Join us at World Aviation Festival 2026 to discuss the future of flight booking and retailing in the age of AI.

For more like this, see:

by WAF_Contributor | Nov 13, 2025 | Airlines, News, Retailing

By Matthias Viehmann, Travel in Motion AG

The airline industry is undergoing one of its most significant transformations in decades. The shift toward Modern Airline Retailing (MAR) is no longer a distant vision—it’s happening now. For years, the transition to Offers and Orders has been discussed, but the pace has accelerated. Airlines have started the transition from legacy Passenger Service Systems (PSS) to modern Offer-Order Management Systems (OOMS) to enable dynamic, personalised retailing.

The transition has profound implications for Revenue Management (RM). Retailing enables dynamic, context-specific offers and a more granular trip-specific customer segmentation. To support this, RM must evolve from managing static fare classes to dynamic offer optimisation, including real-time offer curation and contextualised pricing.

Traditional RM: From enabler to obstacle

For decades, Revenue Management (RM) has been the backbone of airline profitability— managing inventories to balance supply and demand while leveraging customers’ willingness-to-pay. This was achieved through forecasting class-based demand and optimising booking class availability. Historically, these mechanisms worked well to segment demand and differentiate products and prices, but today they limit airlines from creating customer-centric, journey-specific offers. Other industries have long surpassed airlines in modern e-commerce capabilities.

Retailing-friendly RM: What will it take?

Separate product from price

As booking classes and filed fares will become obsolete, airlines gain the freedom to dynamically bundle flights and ancillary services in context-specific offers, and to price them without being constrained to specific price points. Modern product management must evolve to manage components and bundling logic, rather than relying on pre-defined static bundles.

Without classes and filed fares, prices must be optimised for dynamic bundles and à-la-carte ancillaries. Forecasting and optimisation models need to handle contextualisation and dynamic bundle construction. Real-time pricing modules are essential—offline pre-calculation will no longer suffice in such a dynamic world.

Balance “the new” supply and demand for price optimisation

Despite changes to product and price, RM still needs to balance supply and demand and optimise the passenger mix. The optimised price must reflect capacity constraints, whether for seats or limited supplies of certain ancillary services.

Solutions will still need to determine the opportunity cost of the next unit, or, as revenue managers call it, the bid price. The logic extends from seats to capacity-constrained ancillaries. In the future, opportunity cost needs to additionally reflect post-booking ancillary sales of potential future customers and marginal cost of items offered.

Price optimisation will split into two components:

- a capacity-centric view to determine opportunity cost for seats and capacity-constrained ancillary services, and

- a customer-centric view to build and price contextualized dynamic offers.

While the former averages across all demand segments for a resource and can run offline, the latter requires evaluating customer, request, and market context in real-time. As offer creation moves from distribution partners to the airlines, processing requests in real time with high shopping volumes, e.g., from meta-searchers, becomes a challenge that must be addressed for any new-generation price optimization to scale.

Up-level demand forecasting models

Forecasting demand at increasingly granular levels has always been challenging, also for analysts to comprehending, validating, and influencing system forecasts. As demand segmentation becomes more detailed and context-driven in the new world, this will become even more pronounced. Splitting price optimisation into a capacity and customer perspective might allow forecasters and analysts to work on natural aggregates, i.e., leg-level and market-level demand.

Estimating market demand needs to evolve from discrete demand across classes to segment-specific class-less willingness-to-pay (WTP) distributions. This eliminates the restriction of 26 letters of the alphabet and allows unlimited price points.

Adopt a new view of willingness-to-pay and elasticity

While airlines have extensive experience in pricing airfare bundles, dynamic pricing for ancillaries is particularly challenging due to limited historical variability. Techniques such as reinforcement learning can help generate the necessary data while simultaneously exploiting customers’ willingness-to-pay. The potential revenue and profit uplifts justify the effort. Several airlines have reported double-digit uplifts when dynamically pricing ancillaries.

Pricing dynamic bundles is still being researched in the scientific and industry communities. Historically, estimating cross-price elasticities from booking data was virtually unfeasible. Dynamically adding components to bundles and optimising contextualised prices requires addressing cross-elasticities. Additionally, bundle and ancillary prices need to be consistent to avoid confusing customers. For example, a superior bundle including an additional ancillary must not be more expensive than an inferior bundle with the ancillary offered à-la-carte. Improved solutions will capitalise on advances in machine learning, combined with a stronger data foundation moving from traditional bookings to Orders consolidating all purchase information.

Additional data streams, such as competitive insights or shopping sessions, can now be integrated to optimise offers. New data sources will emerge in the future, and solutions must be flexible to incorporate them with limited effort. For example, ski resorts in Switzerland and Austria already today factor in weather forecasts to dynamically price ski passes.

Prepare for organisational changes

The change beyond technology is not to be underestimated. Revenue managers have long thought in terms of controlling the availability of static fares supplied by pricing managers. Pricing has been structured around fares and fare ladders for decades. Ancillary services are usually handled separately from flights. Moving to Modern Airline Retailing will require rethinking organisations and redesigning established processes to break down siloed decision-making into a holistic market/customer perspective and a capacity/flight perspective. This split also helps re-define clear-cut responsibilities in the organisation.

The way forward

While the potential is enormous—with the promise to drive profits and customer loyalty—the transformation process is, without a doubt, complex and challenging. Luckily, vendors and front-running airlines have already developed promising solutions. Airline leaders must start the transition and follow a stepwise approach as systems become available and more sophisticated.

Progress is already happening, at an accelerated pace year over year. For example, continuous pricing is already practiced by many airlines; solutions are available from various vendors. Even with legacy PSS and RM systems, simple interpolation between filed fares is a starting point. Once solutions are capable of determining an optimal price point, discounting filed fares based on context is the next step.

Sequentially, class-less forecasting and optimisation models will replace legacy RM and pave the road to offers in the absence of filed fares. In parallel, modules for ancillary services can be deployed to gain experience and benefit from uplift potential.

Airlines starting the transition on the IT side need to address organizational changes in parallel and can gain valuable experience with newly designed processes.

During the transition, one more challenge will persist for quite some time: airline and distribution partners might not move as fast and still require legacy processes requiring translation layers connecting the old and new world.

In summary, the future of Revenue Management will be a fascinating, complex, and (sometimes) messy process as our industry continues its journey toward MAR.

Join us at World Aviation Festival 2026 to discuss the ongoing transition to Offers and Orders.

For more like this, see:

by Elsie Clark | Nov 10, 2025 | Airlines, News, Retailing

Ethiopian Airlines and Sabre Corporation have announced a new partnership to accelerate the airline’s adoption of Offer-Order.

Through SabreMosaic Airline Retailing, Africa’s largest carrier will pivot to dynamic pricing, personalised offers, and modern distribution. Sabre’s advanced AI and market data capabilities will optimise offers so Ethiopian Airlines can maximise ancillary revenue and create more tailored experiences for passengers.

As part of its Vision 2035 strategy, Ethiopian has set the target of entering the world’s top 20 airline within the next decade. Adopting Offer-Order is key to enhancing the airline’s proposition and making it more competitive with other global carriers in the region.

Mesfin Tasew, Ethiopian Airlines Group CEO, said:

Our Vision 2035 strategy is about scale, speed and service. To achieve it, we must modernise how we retail. SabreMosaic provides the capabilities to move faster, price smarter and give our passengers more choice. Our travellers will benefit from fares that better reflect market conditions, more personalised offers, and a smoother shopping and booking experience across every channel, accelerating our growth and ensuring we deliver even greater value to travellers who choose Ethiopian.

Through a partnership dating back 20 years, Ethiopian is now Sabre’s largest passenger service system customer in EMEA. Other collaborators in the aviation industry include Lufthansa Systems. Elsewhere in the region, new airline Riyadh Air have chosen FLYR as its partner for Offer-Order integration.

Join us at Aviation Festival Asia 2026 to discuss the evolution of retail strategy in aviation.

For more like this, see:

by Elsie Clark | Nov 10, 2025 | Airlines, News, Retailing

InterLnkd’s AirMall, a digital shopping experience platform, will be integrated with Viasat’s Connected Partner Platform to provide airlines with further inflight retail opportunities.

Viasat currently provides WiFi and connectivity services to over 60 airlines, including Delta, Icelandair, and United. The partnership with InterLnkd’s AirMall through Viasat’s Connected Partners Platform will give travellers access to more than 20,000 international brands.

Personalised offers enhance the experience, with the platform making suggestions based on the passenger’s personal profile and travel destination. Customers can then order from their seat and have items delivered directly to their homes or hotels after landing. Airlines do not need to carry any additional stock or hire further staff members to make use of the retail opportunity.

As Viasat VP Inflight Media Nathan Clapton explains:

Many airlines are keen to find smart, scalable ways to earn revenue from inflight connectivity, especially as demand for Wi-Fi onboard accelerates globally. Through our partnership with InterLnkd, airline partners can push the boundaries of in-flight retail without heavy IT investment, delivering a stronger passenger experience while driving new revenue.

Moreover, the InterLnkd platform can be integrated with loyalty ecosystems, allowing passengers to earn or spend points through inflight purchases. InterLnkd CEO Barry Kipps added:

Our partnership with Viasat allows us to introduce AirMall to a global family of connected airlines at speed. It gives carriers a unique and powerful way to monetise real passenger behaviour in-flight, turning the Wi-Fi portal into a digital retail channel that offsets the costs of providing connectivity on board.

Join us at Aviation Festival Asia 2026 to discuss the future of retail in aviation.

For more like this, see:

by Elsie Clark | Nov 7, 2025 | Airlines, News, Retailing

Australian national carrier Qantas have announced they are launching Economy Plus seating. The new seats will provide passengers with greater legroom, priority boarding, and priority access to the overhead luggage bins.

Available from 2026, the seating will be offered to customers on the airline’s fleet of Boeing 737, A321XLR, and A220 jets. These cover most domestic routes across Australia, as well as some international routes to the Pacific Islands and New Zealand. Pricing for the new seats is yet to be confirmed, but Qantas did reveal that Economy Plus will be free to for Qantas Platinum, Platinum One, and Gold frequent flyers.

The new price tier will appeal to business and leisure travellers who want to spend a little extra. Qantas Group CEO Vanessa Hudson said:

This is an evolution of our Economy offering and delivers more choice for our customers while recognising our most loyal frequent flyers with expanded benefits, in the areas we know they value the most.

Economy Plus: another development in premiumisation

Qantas cabins will be reconfigured to create extra space for Economy Plus. Elevated economy offerings have become more popular on short-haul flights as the trend towards premiumisation continues. Earlier this year, Virgin Australia said they were considering added a ‘neighbour-free’ booking option, giving customers the chance to purchase the seat beside them for extra space. And over in Europe, LCC Wizz Air are trialling a new ‘Wizz Class’ seat that offers business travellers more space and other priority benefits.

The desire to charge customers more based on what they are willing to pay could soon extend beyond economy. Qatar Airways recently announced that business class ticket holders will have to pay a fee if they want to select a preferred seat in advance of travel.

Join us at Aviation Festival Asia 2026 to discuss the future of flight retailing.

For more like this, see:

by Elsie Clark | Nov 6, 2025 | Airlines, News, Retailing

SalamAir has announced the launch of a new flight membership scheme, called ‘mOVemore’.

Developed in partnership with subscription travel company Caravelo, the subscription will give frequent flyers a more cost-effective travel option. The scheme covers SalamAir’s portfolio of domestic and GCC destinations, providing passengers with a fixed fare, priority boarding and 20kg baggage allowance.

Customers can choose from two membership tiers offering six or twelve flights every month. Sign-up requires customers to stay on the scheme for a minimum of six months, although flexible payment options allow travellers to start their plan immediately, or at the beginning of the next month. Overall, the subscription hopes to reward loyalty and provide members with more cost-effective options.

Steven Allen, Chief Commercial Officer of SalamAir, commented:

mOVemore is a first-of-its-kind solution for frequent travellers in Oman. It is designed to reward our passengers by reducing their travel cost. Traditional loyalty systems reward passengers with points that are hard to spend on flights. Our mOVemore product removes the guesswork by offering flat-rate pricing and other benefits that make day-to-day travel predictable and affordable. Whether for business, family, study, or leisure, we are giving customers a better way to plan their trips and save more. At the same time, our ongoing fleet expansion, on track to reach 25 aircraft by 2028, ensures that we have the capacity and network to scale mOVemore across more destinations in the near future.

SalamAir joins a list of other airlines who have partnered with Caravelo on flight subscription technology. These include Saudia Airlines and Jazeera Airways. Earlier this month, European LCC Wizz Air also announced that it would be relaunching its ‘All You Can Fly’ pass in response to changing customer habits.

Iñaki Uriz, Chief Executive Officer of Caravelo, commented:

We are thrilled to partner with SalamAir to bring this innovative subscription model to Oman. The Middle East is a key growth market for flight subscriptions, and SalamAir’s forward-thinking approach with mOVemore sets a new standard for customer-centric travel in the region. This membership program is a powerful tool for building loyalty and providing unparalleled value to frequent flyers.

Join us at Aviation Festival Asia 2026 to learn more about the connection between loyalty and technology in APAC and MENA.

For more like this, see:

by Elsie Clark | Nov 4, 2025 | Airlines, Interviews, Retailing

Successfully pivoting to a frictionless Offer and Order retail ecosystem is now considered essential for airlines to boost ancillary revenue and encourage brand loyalty. Alongside hotels and insurance, car rental has been key to airlines’ ancillary offerings. Yet historically, consumer trust in car rental through airlines has been low, limiting revenue.

In an exclusive interview, Bobby Healy, Co-Founder and Chief Technology Officer at Meili, explains how the sector has changed to drive better ancillary revenue results. For a true friction-free booking experience, trust is at the heart of the experience. The customer has to be assured that they are getting the best deal with the airline, and can’t be tempted to shop around elsewhere.

Friction-free is not a technology thing. It’s not speed. It’s not the number of clicks you have to do. It’s about the consumer feeling like they’re in the right place. If they buy something here, they’re safe. They’re not going to get a better price, and they’re not going to have a bad experience.

Healy also discusses how Meili’s marketplace of established car rental brands hopes to transform an industry with an ‘awful reputation’. Unreasonable upselling in the pursuit of margins has in the past made airlines reluctant to associate with ancillary insurance and car rental. However, airlines such as SAS have doubled their revenue from car rental through partnering with Meili, with car rental now the benchmark for all other ancillary offerings.

SAS have got exactly the right approach. They’ve brought on a bunch of trusted car hire brands. The customers see brands that are important or meaningful to them. There’s no shock. And they tie it really well to their loyalty programme.

Looking to the future, Healy sees AI agents as transformative in the airline booking process. In ten years, he predicts booking through AI will be the dominant method, with significant repercussions for ancillary sales.

I think it’s a very positive disruption for direct booking. Because the agents that do transaction and discovery on behalf of the consumer don’t need aggregation. They are the aggregation layer.

🎥 Watch the interview to hear Bobby Healy’s full thoughts on ancillary revenue, car rental, and frictionless booking.

Questions asked include:

- How is the trend for ‘friction-free’ booking changing traveller habits and expectations

- Your platform is all about connecting car rental companies with airlines and travel operators. Why do you think car rental has historically been overlooked as a source of ancillary revenue?

- What kind of business opportunities does the Meili platform open up?

- How can building relationships with external brands and profiles improve airlines’ relationship with customers?

Join us at World Aviation Festival 2026 to discuss the future of airline retail, from friction-free booking to Offer and Order and agentic AI.

For more like this, see: