by Jess Brownlow | Jan 21, 2025 | Airlines, Digital Transformation, Payments, Retailing, Travel Tech

It is now less than a month until Aviation Festival Asia, where some of the most respected leaders from across the industry ecosystem will gather to share insights, troubleshoot challenges, and drive innovation.

With so many sessions to choose from, this weekly series will highlight some unmissable panels and interviews making it easier for you to navigate the event. If you haven’t already – book your ticket now to be a part of the discussion!

Make sure to check the agenda for the latest timings.

Here are the first five sessions that you do not want to miss, in no particular order…

Check agenda for the latest timings (link above)

Check agenda for the latest timings (link above).

Check agenda for the latest timings (link above).

Check agenda for the latest timings (link above).

Check agenda for the latest timings (link above).

by Jess Brownlow | Jan 10, 2025 | Airlines, Digital Transformation, Payments, Travel Tech

AirAsia MOVE (MOVE) signs partnership agreement with leading payments and digitisation services provider, Ant International’s Antom.

The partnership will “redefine the way customers experience travel payments,” through integrating Antom and 2C2P’s (an Antom subsidiary and full-suite global payments platform) advanced payment solutions into the MOVE platform.

In addition to offering customers a broader range of payment options, this will reduce cross-border transaction costs, operational expenses, and streamline payments.

Speaking on the partnership, Nadia Omer, CEO of AirAsia MOVE said:

“We aim to simplify the complexities of cross-border transactions through this partnership and it also aligns with AirAsia MOVE’s vision of providing seamless travel experiences. By leveraging Antom and 2C2P’s robust payment infrastructure, we can offer greater flexibility and convenience, addressing the diverse needs of our growing customer base in Asean and beyond.”

Gary Liu, General Manager of Antom, Ant International added:

“Our advanced solutions, including payment orchestration and acquiring for both cards and LPMs, enable AirAsia MOVE to expand its reach to more consumers across the Asia-Pacific region and beyond. By combining our expertise and AI-driven payment technologies, we are committed to improving operational efficiency, enhancing customer satisfaction, and unlocking long-term value together.”

At Aviation Festival Asia next month, Omer will be speaking on:

- Becoming more proactive, personalised and predictive to meet soaring passenger expectations

- How MOVE is redefining the travel experience through customer-centric strategies and innovation in the APAC region

- How airlines can reform and restructure ancillary offerings based on the expectations of the 2025 APAC passenger

Book your ticket now to be a part of the conversation!

For more like this also see:

by Jess Brownlow | Jan 9, 2025 | Airlines, Digital Transformation, Interviews, On-demand, Payments

At World Aviation Festival, Serdar Gürbüz, General Manager, Turkish Technology highlighted three core trends in the payments landscape.

Gürbüz spoke on crypto, digital wallets, and disruption in payments, pointing out their significance to the evolving ecosystem.

Drawing on experience with TK Wallet, Turkish Airlines’ digital wallet launched last year, Gürbüz illustrated how virtual wallets can be used to streamline currency exchange, connect with customers outside of travel dates, and resonate with young, tech-savvy users.

Acknowledging the major challenges around innovation in payments, Gürbüz added:

“The hardest thing is about being regulated. Payments in every country is a regulated area and it is especially challenging for airlines as they are working across different countries. So in order to comply across countries it takes a lot of effort and many partnerships…”

To find out how Turkish Technology overcomes this challenge and learn about the scope for growth with digital wallets, watch the full interview below.

Questions asked include:

- 1. Starting with a broad view, what core trends are we currently seeing in the payments landscape, and which of these do you think are here to stay?

- What are the greatest challenges when it comes to innovation in the payments space?

- How do you envision digital wallets shaping the travel experience of the future and how much scope is there for growing these in the future?

For more from onsite at World Aviation Festival see:

by Jess Brownlow | Dec 31, 2024 | Airlines, Airports, Digital Transformation, Payments, Retailing, Travel Tech

As 2024 draws to a close, we are reflecting on the news and topics that grabbed your attention this year. Here are the top five most read articles of 2024.

1. Alaska Airlines’ AI-powered destination flight search tool

This month, Alaska Airlines made its AI-powered flight search tool available to all website visitors. During initial trials in April and May with the feature only open to 5 and 15 per cent of searchers, it was reported as imperfect but promising for the future of travel booking. The “AI destination search tool” leverages tech from Microsoft and OpenAI’s generative AI to offer customers a new and inspiring way to search for flights. Notably, the tool incorporates the airline’s loyalty programme, enabling visitors to search for flights requiring a specific number of loyalty points or for those that will earn them many points…Read full article

2. 26 challenges and opportunities on aviation’s road to 2050

I thought I’d take a step back and look at challenges and opportunities facing Aviation until 2050, across eight areas. I’ve listed 26 topics below, like the number of years to go until 2050. In 2024 the main challenge facing air transport, but also the biggest opportunity, may be sustainability. The sustainability of an industry is the balance between the benefits and costs to the society. In the case of air transport, the benefits in terms of jobs and economic development may represent about 2-3% of the world’s GDP (about $2.5 trillion compared to $100 trillion[1]), whereas the costs to society include about 2% of human-induced greenhouse gas emissions (about 1b…Read full article

3. Star Alliance launches loyalty status match initiative

At the start of the week, Star Alliance launched a new loyalty status match initiative powered by StatusMatch.com for frequent flyers in Scandinavia. The announcement came the day after SAS officially joined SkyTeam’s global airline alliance following its exit from Star Alliance in August. The loyalty offer empowers passengers to a claim a “status match/challenge” across select member airlines in Scandinavia. Participating airlines include Air Canada, Air China, Air India, Ethiopian Airlines, Lufthansa Group airlines, South African Airways, TAP Air Portugal, THAI, Turkish Airlines, and United….Read full article

4. ESG in the world of airlines

In the fast-evolving landscape of the airline industry, the adoption of Environmental, Social, and Governance (ESG) principles is increasingly becoming a pivotal factor in shaping the strategies of airlines. In this blog I explore how airlines are integrating ESG to contribute to a more sustainable and responsible future for air travel – not only by compensation or using sustainable aviation fuel (SAF). ESG in airline distribution, for example, starts with a focus on reducing the environmental impact of distribution processes. From paperless ticketing to digital boarding passes, airlines are leveraging technology to minimize the use of paper, thereby decreasing their ecological footprint. This m…Read full article

5. Turkish Airlines announces strategic partnerships with leading content aggregators after removing fares from Sabre

On Wednesday, Turkish Airlines released an announcement on the expansion of its TKCONNECT programme. The programme, which is fully compliant with New Distribution Capability (NDC) standards will equip agents with state-of-the-art tools and a streamlined booking process, amongst other benefits. As part of the release, the airline highlighted its strategic partnership with leading content aggregators including Travelfusion, Verteil, DRCT, Mystifly, Nuua, Nuflights and Theta. AirGateway will also be one of the launching partners…Read full article

What do you think will be the biggest topics to explore in 2025?

by Jess Brownlow | Nov 14, 2024 | Airlines, Airports, Digital Transformation, Payments, Retailing, Travel Tech

DOWNLOAD FOR MORE INSIGHTS

by Jess Brownlow | Nov 13, 2024 | Airlines, Payments

This week, Etihad Airways added several new features to its website and mobile app adding greater payment flexibility and personalisation for passengers.

Passengers in key markets, including Europe and India now have the option to use local payment methods, aligning with the airline’s mission to deliver a more personalised booking experience. In India, passengers can also access an innovative fare calendar and utilise support offered in Hindi.

These updates come alongside a focus on improved loyalty features and an increased emphasis on agency for passengers. Now, customers will benefit from a “more intuitive” booking process with elevated self-service options, and more.

Speaking on the updates, Arik De, Chief Revenue and Commercial Officer at Etihad Airways, said:

“The growth in our digital channels has been remarkable, with online direct sales increasing significantly across our key markets. The close collaboration between our Commercial and Digital Technology teams has enabled us to rapidly deliver solutions that our customers want. These enhancements are driving higher customer engagement and growing ancillary revenue through a more personalised booking experience.”

To keep up with the latest payments trends in the APAC region, book your ticket for Aviation Festival Asia where speakers from Air India, SriLankan Airlines, Oman Air, AirAsia SuperApp, and more are unpacking the future of digital payments and customer experience.

For more like this also see:

by Jess Brownlow | Nov 11, 2024 | Airlines, Airports, Digital Transformation, News, Payments, Retailing, Travel Tech

Last month, World Aviation Festival welcomed thousands of attendees for three days of inspiring sessions, workshops, and networking opportunities.

With over 300 sessions across 20 tracks, this year’s event took a microscope to the latest trends, innovations, and strategies, driving innovation in the industry. Senior Conference Producer, Katie Duffin shared her personal highlights from the event:

“From the perspective of the conference producers, several highlights made the 2024 World Aviation Festival truly exceptional, for example, this year marked the successful launch of several new and highly engaging summits, each addressing critical aspects of the future of aviation:

Digital Sustainability Summit:

With sustainability being one of the aviation industry’s top priorities, the introduction of this summit allowed industry leaders to discuss innovative ways to achieve net-zero emissions through digital solutions. This summit brought together sustainability experts and tech innovators, driving meaningful conversations on how data analytics, AI, and other digital tools can reduce the carbon footprint of airlines and airports.

Digital Accessibility Summit:

Another critical addition to this year’s event was the Digital Accessibility Summit, which focused on how technology can improve the travel experience for passengers with disabilities. Attendees were particularly drawn to discussions around how airports and airlines can better accommodate travellers with hearing impairments and mobility challenges. This summit was a vital step toward ensuring a more inclusive travel environment.

Customer Experience Design Summit:

The importance of customer satisfaction was highlighted with the Customer Experience Design Summit, which focused on personalising the passenger journey. Airlines and tech companies showcased how cutting-edge digital interfaces and seamless interactions can enhance the overall travel experience, ensuring customers feel valued from booking through to landing.

These highlights, alongside the broader themes of technology, innovation, inclusivity and sustainability, made the 2024 World Aviation Festival a truly memorable event, setting new benchmarks for future editions.”

The post event report is now available if you could not join us in Amsterdam or simply want to:

- Review session highlights

- Read our key takeaways

- See the event in numbers

- Take a look at attendee reviews

- Access the official photos

- Watch the event highlight reel

- Join us in 2025

If you are interested in joining us for 2025 in Lisbon, find more information here.

by Eric Leopold (Threedot) | Oct 15, 2024 | Airlines, News, Payments

By Eric Léopold, Founder, Threedot

In 2011 I wrote a business case for a new project called New Distribution Capability (NDC). Around the same time, as distribution and payment are closely related, I was working on another one for a New Payment Capability (NPC). The approach was similar: improve the customer experience by leveraging modern technology. However, other dimensions of these initiatives, from the roles of incumbents to their business models, varied a lot between the two domains. IATA ended up launching multiple payment projects, such as IATA EasyPay. What would an airline’s New Payment Capability look like today?

Customer experience

One of the most customer-friendly payment experiences today is probably Alipay, at least from my recent experience in China. It works online (mobile) and offline (QR). The service apps (mobility, etc.) are integrated in the Alipay app. It includes peer-to-peer payment, i.e. the app can receive payments (unlike a credit card). The integration with apps is native, there is no add-on security feature that disturb conversion, like “3DSecure” for credit cards, unless a foreigner feeds the app with a credit card.

While modern payment methods provide instant money transfer, bank transfers may still take days. The parallel with paper mail vs e-mail makes one wonder how long multi-days bank transfers will resist to instant transfers.

In summary, customers get the instantaneous (1-click) experience without compromising security.

Payment methods

Different regions have embraced specific mainstream payment methods. In Europe and North America credit and debit cards are dominant, but not in China where QR codes are widely used. In India UPI is a standard for bank-to-bank transfer, whereas mobile payment is most popular in Kenya. In parallel to all forms of digital payment, traditional cash is still used and it’s fascinating to witness how some taxi drivers still prefer cash for “financial” reasons.

Global travelers need a payment capability that is accepted globally based on local preferences.

Currencies

An ideal payment solution, or capability, should facilitate the usage of a range of fiat currencies (USD, EUR, GBP, CHF…) as well as points from loyalty programs and crypto currencies, depending on the needs and preferences of customers. At the same time, prices need to be displayed in each currency or type of currency.

Installments and credit

The popularity of Buy-Now-Pay-Later (BNPL) solutions enabling payment by installments has grown in the airline market as flights represent a relatively high expense.

While instant payment provides speed, slower bank methods can provide credit facility. BNPL solutions show how credit scoring can be automated and seamlessly integrated into payment processes.

Security, fraud and chargeback

Mobile wallets enhance payment convenience by adding a storage layer where customers can manage multiple payment methods and handle security through biometric checks and tokenization.

At the same time credit card transactions may generate issues. The cost of card fraud to airlines may exceed $1Bn per year. In 2019 in IATA settlement systems, agent debit memos for card chargebacks represented 20% in value. In the chargeback scenario, the customer disputes a card transaction, either incorrect or unauthorized or the service was not delivered.

The ideal payment capability would necessarily reduce fraud and related payment issues.

Business model

Payment methods that offer rewards, often funded indirectly by merchants, may face limited acceptance by merchants due to their higher transaction fee, or be accepted with a merchant surcharge where regulation allows it.

Payment is regulated in some markets, e.g. Europe has voted the Payment Service Directive, which may limit the amount of transaction fees or the ability to add surcharges.

Regardless of the business models and hidden costs, customers expect transparency in payments.

Conclusion

Travel services represent a large share (maybe 20-30%) of the global E-commerce sales and digital payments.

There is potential to significantly improve the payment experience in the travel industry by leveraging modern technology. The NPC would define how customers can safely store payment methods in digital wallets and connect them seamlessly to travel merchants, so that every payment transaction is safe and frictionless.

For more from Eric Léopold also see:

by Jess Brownlow | Sep 16, 2024 | Airlines, Digital Transformation, Payments, Travel Tech

Google reported that one of the top requests for digitising everyday items is a digital ID. Responding to demand, the company is working to allow users to store their US passport in Google Wallet.

Although some state-issued digital IDs have been compatible with Google Wallets since last year, on Thursday the tech giant announced it will begin beta testing a new type, “giving more people in more places a way to create and store a digital ID, now with a US passport.”

The process of creating the ID pass only takes a few minutes, with users following prompts in the Google Wallet app to scan the security chip in your passport, take a selfie video, and wait for the pass to be finalised.

For now, this form of ID can only be used at select TSA checkpoints for domestic travel and cannot be used as a replacement for physical ID.

However, Google is working with governments, regulators, and relying parties to expand their use. This is big news for the industry, but the implications of digital ID go well beyond travel. In an article written the Group Product Manager of Google Wallet, Alan Stapelberg said:

“Digital ID adoption will truly scale when daily use cases like driving a car, picking up prescriptions and more can be done with a digital ID. There’s also a future where digital IDs can be used for things like online tax filing, signing a home loan, opening a bank account or signing up for medical benefits — all from your phone. And the industry is working to make these things happen.”

At World Aviation Festival, Serdar Gurbuz will be doing presentation on revolutionising air travel payments with digital wallets. Book your ticket now to be a part of the discussion!

For more like this see:

by Jess Brownlow | Aug 30, 2024 | Airlines, Digital Transformation, Payments

Yesterday, Riyadh Air announced its latest partnership with secure digital payment solutions provider noon Payments. Together, the companies will work to “redefine what it means to travel well,” crafting an exceptional payments experience for passengers.

noon Payments, part of the wider noon Group, leverages cutting-edge tech to innovate payments, delivering a seamless and reliable experience for users. This collaboration will elevate Riyadh’s overall guest experience, offering secure, convenient transactions with “industry-leading” features.

Announcing the partnership, Riyadh Air noted that additional benefits to passengers include card acceptance and alternative payment methods.

Speaking on the collaboration, Adam Boukadida, Riyadh Air’s Chief Financial Officer explained:

Our partnership with noon Payments allows us to tap into their expertise in digital solutions, which will optimize our operational efficiency while offering guests a familiar and trusted payment method. This will be another step of changing the way that global travelers to book flights and pay for flights. It also shows our dedication to fostering local innovation and contributing to the broader economic goals of Saudi Arabia.

The ambitious new carrier aims to connect the Kingdom to the rest of the world, planning to fly to more than 100 destinations and reach 100 million visitors by 2030. As it prepares to launch, Riyadh Air has announced a string of partnership that will help it redefine the travel experience.

At World Aviation Festival, Riyadh Air’s CEO Tony Douglas will be speaking on a panel exploring how CEOs are approaching structural industry shifts, potential for growth, sustainability implications and AI business transformation. The airline’s Chief Commercial Officer and VP Digital, Technology & Innovation will also be speaking at the event on retailing and predictive modelling. Book your ticket now!

For more on Riyadh Air see:

by Jess Brownlow | Jun 11, 2024 | Airlines, Payments

Today, Riyadh Air announced it will be partnering with Cellpoint Digital to support its digital-first business strategy. The airline will be offering a variety of payment options to both international and domestic passengers, enabling travellers to pay the way suits them.

The new national carrier is leveraging Cellpoint Digital’s tech to ensure reliable, streamlined local and cross-border transactions, while minimising declined transactions using intelligent routing.

Kristian Gjerding, CEO, CellPoint Digital said:

“While legacy airlines can be held back by legacy technology, a next-generation airline like Riyadh Air can start from a more advanced position by using tailored technology that’s whbuilt for now, not 20 years ago. With our Payment Orchestration solution developed specifically for the unique challenges faced by global airlines, Riyadh Air can offer travellers their preferred payment options while gaining more control over its cash flow and costs.”

Adam Boukadida, CFO, Riyadh Air’, added:

“As a disruptor airline prioritising our digital capabilities, we need a payments partner with first-hand, in-depth knowledge of air travel. CellPoint Digital’s Payment Orchestration platform enables us to offer travellers a fully digital and immersive experience onboard and a smoother booking experience. This will enable us to provide a better global service to our customer as we look to connect Riyadh to over 100 destinations by 2030.”

Airlines must navigate the balance between ensuring a seamless, convenient transaction process and robust security measures. Having a secure, seamless payments process is critical to reduce abandoned bookings and drive revenue. Read more here.

For more on payments see:

by Jess Brownlow | May 29, 2024 | Airlines, Payments, Travel Tech

Yesterday, retail and payments solutions provider, MOST announced their partnership with Hawaiian Airlines.

Specialising in fintech and travel retail, MOST helps shift away from legacy payment and retail platforms to simplify the payments process. The partnership enables Hawai’i’s largest airline to innovate their inflight retail experience, deploying their “Pau Hana” Point of Sale app. The new “bring your own iPhone” retail strategy enables crew members to directly convert their iPhones into “efficient payment solutions.”

Aligning with the airline’s commitment to convenience and guest satisfaction, the partnership represents a step towards modernising the inflight experience at Hawaiian.

In a statement, Jan Blanchard, CEO, MOST emphasised the synergy between the companies:

“Collaborating with Hawaiian Airlines represents a significant milestone for MOST. Our solution’s agility and adaptability align perfectly with Hawaiian Airlines’ commitment to providing a seamless and convenient guest experience and also improving technology for employees.”

Alana Gaitley Jones, Product Manager of Product Development at Hawaiian Airlines pinpointed enhanced flexibility as one of the key benefits from the partnership:

“Partnering with MOST has enabled us to improve our onboard sales process, setting a new standard for guest engagement. The flexibility and efficiency of the solution empowers our crew to deliver exceptional service at every touchpoint.”

Hawaiian Airlines is the latest addition to a growing selection of airlines partnering with the payments solutions provider including Southwest, Emerald Airlines, and PLAY airlines. With airlines increasingly prioritising streamlined payments process and flexibility onboard, partnerships will play a crucial role in elevating operational efficiency and the overarching passenger experience.

For more like this see:

by WAF_Contributor | May 17, 2024 | Payments

And it happened again! I was constructing a complex flight itinerary online, reflecting the preferences of my wife and our three adult children. I managed to create the perfect combination of segments at a good price. Only one final step was still pending: payment. I entered my credit card details and … an authentication through the app on my mobile phone was required. But where was my mobile phone? Not at my desk, not in my office – so I tried to call it from my landline, but remembered at the same that I muted it. Therefore, I ran two floors downstairs to the living room, still could not find the damn thing, but saw my Apple watch. I pinged my mobile phone, after shouting out to everyone to be silent for a moment and finally found it on the terrace. I accepted the payment on my phone (pretending not to hear my wife asking me to help in the garden), went back upstairs to my office only to see that the session of my favourite flight portal had already ended. No payment, no conversion and not a good customer experience, but a very secure (unfortunately unfinished) payment process.

I am sure that I am not the only one who has experienced this. We all understand that there is a big need for an airline, as with all other online retailers, to execute payment securely as the number of fraud attempts (e.g., using stolen credit card data) has continuously risen over the decades. Increasing security by enforcing regulations such as PSD2 (Payment Service Directive) and 3D Secure are de-risking payments but are also creating complexity and may even negatively impact conversion, as customer experience suffers.

At the same time, payments are increasingly becoming a significant cost factor for an airline. Numerous studies assume that payment costs represent up to 3% of airline revenues, which is very close to the annual profit our industry is usually achieving on average. McKinsey summarizes that annual payment costs for airlines have already hit the $20 billion barrier.[1]

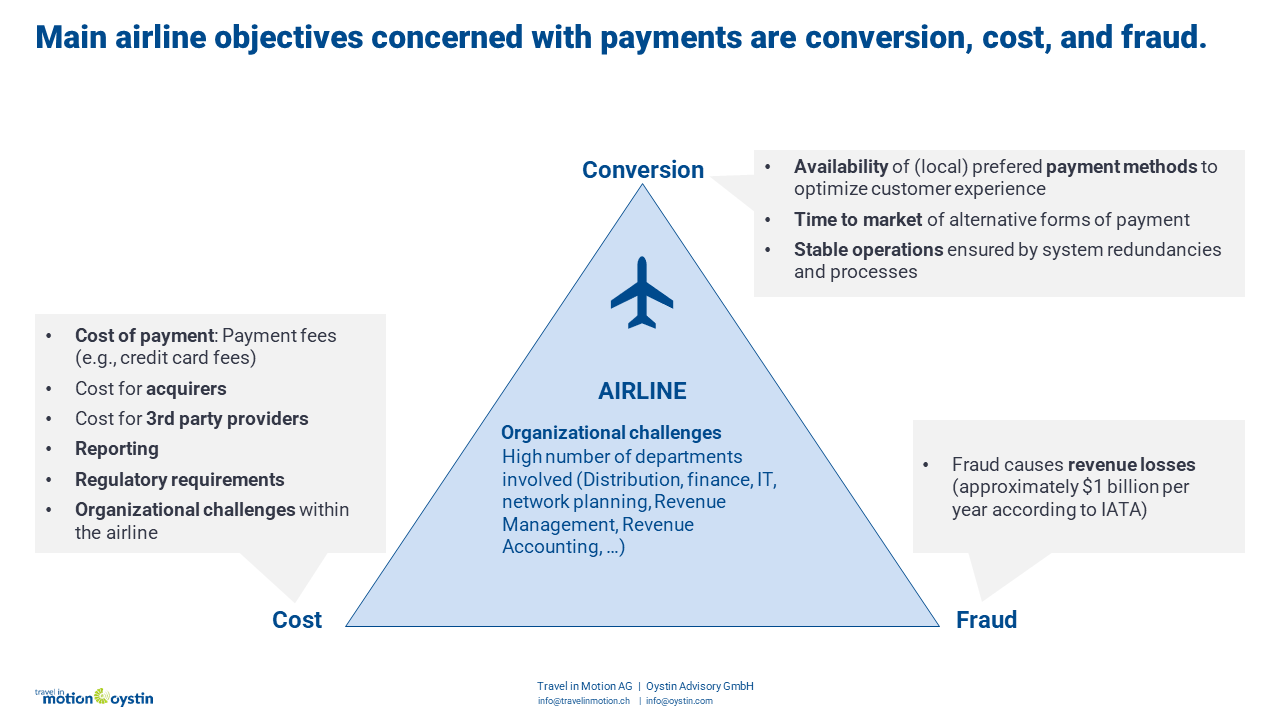

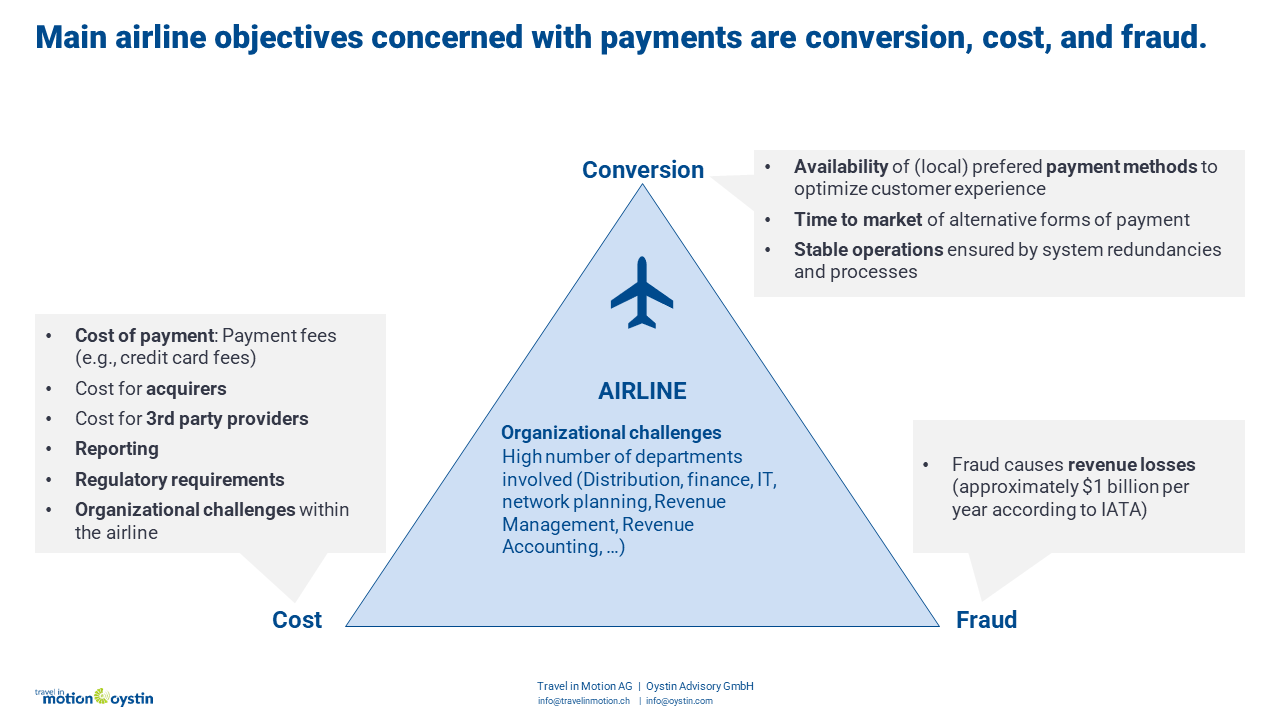

What does this mean for an airline that is working on a payment strategy? In essence, an airline needs to optimize three strategic components: conversion, fraud prevention and cost efficiency. But these targets are conflicting. Conversion can be increased by the provision of easy and straightforward payment processes. However, this approach may compromise on security. Indeed, in my illustrative, but “based on a true story” example, I have not converted as a client, because I wasn’t able to meet the security requirements of the payment process. In this case, security took precedence over conversion – and I think for a good reason.

Let us take another example: supporting local payment methods is becoming increasingly a necessity for airline retailing. In Switzerland, “Twint” is one of the most used alternative payment methods (APM). Many local retailers support it, as it is secure, provides a good customer experience and Twint claims to lead to increased conversion rates. But APMs are known to be costly for retailers, especially if they need to support different APMs in different markets.

We do not need a lot of imagination to identify and describe other combinations where increasing conversion, reducing fraud and reducing cost are conflicting targets. Our payment “guru” Urs Kipfer summarizes this dilemma in a triangle.

It is obvious, that an airline’s payment strategy must follow a holistic view, which defines the strategic target that should be achieved, and thus also takes into account the need to compromise on the other targets. As airline organizations traditionally have the tendency to be complex, it is essential to include all internal stakeholders – especially as the affected business units may have conflicting interests among themselves.

A strategic approach that clearly defines the targets to be achieved, includes internal stake holders and is driven with the airline’s senior management endorsement is essential for success. It is worthwhile to choose to follow this path. McKinsey estimates that our industry is not addressing an annual $14 billion in potential revenues and savings. Missing revenue opportunities during the payment process itself, too complex payment methods and unaddressed cost reductions all contribute. It is now time to strategically address the payment potential for every airline!

In the end I finally booked our flights – but used a different portal, as my initial itinerary wasn’t available any longer. But I still had to run down two floors afterwards, again – this time to help in the garden, but this is another story.

Article by Boris Padovan, Travel in Motion AG

[1] McKinsey Sep. 2022 – Airline retailing: How payment innovation can improve the bottom line. (https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/airline-retailing-how-payment-innovation-can-improve-the-bottom-line)

by WAF_Contributor | Apr 29, 2024 | Airlines, Payments

- Navigating a New Era of Travel

- Travel, Airlines and Hospitality Trends to Watch

- Payment and Technology Issues and Innovations

- What’s on Our 2024 Watchlist

Navigating a New Era of Travel

Travel, Airlines and Hospitality continued to bounce back at scale in 2023. Trans-continental connectivity was revitalised as Asia Pacific, the slowest region to reopen its borders, enjoyed a first full year of unrestricted travel since 2019. In October 2023, global air capacity matched the 2019 level for the first time. Airports on all continents handled impressive passenger numbers despite high air fares and airline capacities that were still rebuilding.

As more business and leisure travelers took to the skies, airlines and hotels recorded dynamic revenue growth. Business travel continued to recover supported by a resurgent meetings, conventions and exhibitions sector. Demand for travel proved so strong that the pre-pandemic term “over-tourism” resurfaced during the northern hemisphere summer.

If 2023 restored upbeat sentiment to the travel industry, concerns emerged that the post-pandemic honeymoon period may be nearing an end. Macro-economic uncertainty, geopolitical schisms and two major conflicts could potentially decelerate growth in 2024. Conversely, resilience borne from the unprecedented challenges of Covid-19 could see travel stay in the fast lane. Either way, there will be many unknown factors to navigate.

This paper sets out the landscape for Travel, Airlines and Hospitality in an unfolding new era. We can look forward to exciting technological advances and entrepreneurial solutions to the planet’s environmental challenges. AI adoption will drive digital transformation in 2024, while payment solutions will remain centre stage in the debate about the future of travel.

Travel, Airlines and Hospitality Trends to Watch

Recovery Fades, Growth Pressures Increase

By the end of 2024, the world will complete a five-year Covid cycle. Even so, the travel recovery may remain uneven. Lagging far behind in 2022, 2023 saw Asia Pacific accelerate its catch-up and end the year much closer to other regional markets. This will continue. As a result, 2024 will see a competitive global landscape. Cost pressures will intensify, growth rates moderate and a quest for consumer value gain momentum. Travel businesses can mitigate this through price signalling further out in the booking journey and achieve cashflow benefits.

Climate, Sustainability and Seasonality

Travel industry narratives about consumers wanting to be more sustainable in their travel choices will be tested. Irregular weather patterns and extreme climate events will become more frequent and the outcomes longer lasting. This could prompt pattern changes for the seasonality of domestic and international tourism. The travel industry must confront complex issues related to the environmental and community impact of travel and engage consumers as partners for the long-term. In 2024, we could witness the start of long-term shifts in how, where and when people travel and spend.

Virtual Interlining with LCCs

As aviation reshapes, agile low-cost carriers (LCCs) are spotting new windows. Data by OAG shows LCCs comprise 34% of global seat capacity. In four regions, they operate more than half of departing capacity: South Asia 62%, South East Asia 52%, Central America 50% and Lower South America 50%. Budget flying is extending beyond domestic and short-haul. Virtual interlining tools enable online bookers to plan trips using LCCs on all continents. Specialist LCC distribution service providers will gain scale as consumers invest more time researching deals and localised payment formats will unlock bookings in Asian markets.

OTAs and a Complex Channel Landscape

Mobile booking is transforming travel distribution, albeit at variable speeds in global regions. While OTAs expand their inventory for B2C distribution, specialist B2B solutions providers are supporting the channel expansion strategies of SME travel suppliers. In regions with strong hotel pipelines, like the Middle East, Asia and Africa, OTAs will connect more mobile-centric travellers with rooms and in-destination experiences. Contributing to channel fragmentation are Asia’s Super Apps, Mini Programs and Social Commerce, which offer direct pathways to sell FIT and traditional agency travel products direct to consumers.

Upselling Ancillaries

Stubborn inflation will influence the cost of travel. Purchasing travel is segmenting as hotels, airlines and OTAs promote new ancillary products and services. Adding a ride-share, pillow upgrade or date-change raises the average spend of mobile bookers. In 2024, travellers also face new visa charges for the EU, UK and Bali. More cities will trial tourist taxes to limit visitors, while a rail pass price hike makes exploring Japan more expensive. Pricing factors will influence travel consumers to be highly alert for additional costs when planning each trip.

Payment and Technology Issues and Innovations

Managing Costs & Processing Efficiency

Global airline capacity in 2024 is forecast to match and exceed 2019 levels, although regional variations will apply. Stronger route competition and rising costs will place downward pressure on revenues and margins. Record profits announced by many carriers in 2023 should moderate. This will increase the pressure to optimize transaction processes and capture every payment opportunity, both in-market and across borders. Payments have a high cost in terms of margin, and travel industry discussions will focus increasingly on cost transparency and processing efficiency.

On-Demand Mobile Travel Payments

China and Asian markets continue to drive mobile payments. Phocuswright forecasts that mobile will comprise 93% of gross online travel bookings in China by 2026, and 54% in South East Asia. This compares to 47% in Europe and 23% in Australia/New Zealand. Local market factors influence smartphone booking preferences for flight tickets, hotel rooms and airport train transfers. Mobile payment apps can make in-destination travel decisions more spontaneous. In Macau, casino stakes, concerts and musicals, cable car rides, fashion previews and drone shows can all be booked on-demand by a mobile app.[1]

Payment Security and Trust

While Covid is in the rearview mirror, the memory lingers about the levels of risk it rendered. Global travel companies will step up due diligence protocols for payment providers. As travel rebounds, their strategic outlook is to ensure they work only with strong partners. The requisite strength is found both on the balance sheet and in commercial reliability and trust. Distributing risk will be another focus, as travel firms manage payments by optimizing the cost of processing. This is particularly important for controlling foreign exchange risks.

AI: From Disruptor to Centre Stage

AI is an intrinsic part of every travel conversation. Few technologies have moved so swiftly from disruptive shock value to global assimilation. In 2023, travel brands frequently launched AI solutions. In 2024, the utility of those tools will come be tested. Many industry insiders believe AI will fundamentally change how OTAs, hotels, airlines operate. Others contend that the risks and benefits are yet to be assessed. Opportunities exist for companies to better understand payment touchpoints, create more actionable data and improve operational efficiency. Consumer-facing AI will aim to transform trip planning and travel management.

Asia Leads on Biometric Adoption

Mobile-native Asian markets spawned Super Apps and popularised QR-code payments. App platforms are driving two-way digital behaviors. AirAsia is a travel-first app incorporating consumer and financial services, whereas Grab is bringing travel elements to its consumer-first platform. These create biometric propositions. Chinese consumers use iris-scan payments and palm-recognition ticketing on the Beijing Daxing International Airport train. Airports are integrating biometrics at immigration points. Singapore Changi plans to eliminate passport verification for passengers. Hyper-localised payments benefit domestic travellers but incur challenges for visitors unfamiliar with local apps. Biometric adoption could eliminate these barriers.

Managing Currency Volatility

Currency fluctuations have caused post-Covid tribulations for travellers and for the dollarized airline industry. The effects are unlikely to subside in 2024 as a global slowdown, enduring conflicts and energy scarcity increase pressure on emerging market currencies. More countries in the Global South will trade with China in RMB to mitigate dollar deficits. Travel suppliers will offer app-based solutions for customers to pay in local currency wherever possible. Central banks in China. ASEAN and the Middle East are entering cross-border QR code payment agreements to reduce the impact of currency volatility on travel spending.

Partnerships Really Matter

How you manage payment streamlining for all parties without creating headaches for consumers? That question will be repeated frequently in 2024. A further deepening of B2B partnerships will help alleviate potential pain points for travellers. Travel value chains will count ever more on partnership solutions as loyalty among consumers dissipates and price and value take precedence. Hotels, OTAs and airlines recognise that working together can bridge payment gaps along the travel journey and offset higher cost bases.

Outlook from the Regions

Damien Cramer, Global Head of Travel & Airlines

The tailwinds of the post-Covid recovery presage a whole new competitive era in travel. The immediate future will bring a US-led economic slowdown, lingering inflation and geopolitical tensions. Businesses won’t be able to operate with the same margins they enjoyed in 2023.

Twelve months ago, we identified three factors – localisation, fraud management and data solutions and maximizing authentication rates. At the time, these were important but fairly isolated trends. In 2024, they will be much more strategically connected. Another concept to watch is ‘digital identity.’ This could become fundamental in the context of travel security and payments, with Asian markets leading the way.

Ivan Guerrero, Director of Travel & Airlines, EMEA

Due to mixed economic signals, Europe is seeing less spending on travel, even though people have saved more money. This will affect how tourists and business travellers choose to travel. Despite these challenges, leisure travel is still popular and travellers seek genuine experiences and good deals. A trend to watch is that during summer, Europeans are choosing cooler places like northern Europe and the US. As a result, leisure flight bookings will undergo significant changes in various countries. A developing trend towards mobile payments and social commerce is expected to increase.

Liyana Khan-Bah, Key Account Manager, APAC

India, Indonesia, Thailand and Vietnam are emerging outbound markets. Indian outbound tourism registered a 190% annual increase in 2022, and is forecast to be worth $44 billion by 2032. Pent-up travel demand from China will have a positive effect across Asia Pacific and the global tourism industry. Regional travelers will take more long-haul trips, with the US and Australia being popular destinations. Generative AI is taking over the role of a travel agent to prepare personalized itineraries within seconds. Platforms like Roam Around and Vacay will make research-intensive travel planning effortless.

Virginia Cicchini, Director of Travel & Airlines, Americas

Air travel in the region has recovered to 97% of the 2019 level, according to IATA. Brazil, Mexico and Colombia are leading the way with above-2019 capacity. Passenger demand for LCCs is now above pre-Covid levels. Long-haul continues to recover with the reopening of key routes that were delayed after the pandemic. OTA consolidation took place during the Covid-19 period, while new local regulations related to short-term rentals have deflated rental demand and increased prices. Pix continues to grow in Brazil as the payment method of choice.

Our 2024 Watchlist:

- China’s outbound recovery

- Business travel rebound

- Jet fuel prices

- OTA price competition

- Next steps for CBDCs

- Booking window trends

- Impacts of major conflicts

- 40 Government elections

- The concept of Digital Identity

Article by Worldline

[1] Phocuswright. China Travel Market Report 2022-2026 / Southeast Asia Travel Market Report 2022-2026 / Europe Travel Market Report 2022-2026 / Australia-New Zealand Market Report 2022-2026

by WAF_Contributor | Mar 11, 2024 | Digital Transformation, Payments, Travel Tech

How airlines can facilitate greater B2B payments acceptance by unlocking the benefits of agent cards

The B2B travel payments landscape has seen a significant shift towards digitalization, largely driven by the Covid-19 pandemic. A recent research report predicts that the total number of B2B transactions with virtual cards, including those in the travel sector, will increase to 740.7 million by 2028, from 189.9 million in 2023. What’s more, by the year 2028, B2B payments are forecasted to make up the majority of virtual card transaction value; accounting for up to 77.8% of the total value, at $10,771.3 billion. The implementation of agent cards is a key driver of this growth, with the travel sector seeing increasing prevalence, due to the financial benefits and enhanced security they offer. However, the acceptance of agent cards by some travel suppliers remains a barrier to adoption across the ecosystem.

The leading reason cited by airlines for not fully accepting agent cards is typically cost. While a focus on merchant fees can lead to the perception of agent cards as more costly than traditional methods thorough cost and benefit analysis would highlight significant revenue opportunities. Read on to discover how airlines can benefit from agent cards and implement a successful acceptance policy.

Article by VISA

by WAF_Contributor | Jan 30, 2024 | Payments, Retailing

It doesn’t matter if we are talking NDC or not the biggest hassle seems to be changes. Not only is it costly it is complex. You would think with automated coding and automated tools to change that this would be no big deal but, in every discussion, we keep coming back to servicing as the biggest challenge for both corporate and leisure travel. In the debate we hear “Change has not been implemented for NDC bookings”, “Our main reason for not implementing NDC is the challenge with servicing”, “Servicing remains the biggest challenge to our automation flow”, “Customers do not understand what they are paying for”. Isn’t it time that we start thinking about how we can modernize this process?

Changes are a corporate pain point

At the latest GBTA conference a corporate stated that they deliberately book as many one-way trips as possible as they struggle with the change process. Not only do they think they are overpaying for the service of change it has become an impediment to innovation. It is easier to book one-ways and gives them much more flexibility. Question is if airlines ever expected this to be the case? Very similar to virtual interlining that airlines never really saw coming.

Changes are a pain point for leisure travel too

And it is not only corporates that struggle with changes. On various online travel forums one of the most important questions is “Why do I have to pay a penalty not to fly”, “Why do I lose my flights from New York to London if I don’t fly from San Diego to New York?” “Why do I have to pay $3000 just to change one flight on my itinerary”. The ugly truth is that passengers do not understand the complexity and it also resonates less and less that I just forfeit a trip I want to cancel.

Changes are a pain point for airlines

For airlines servicing, exchanges, and refunds are constantly brought up as customer pain points. After the pandemic, tons of vouchers were added to the complexity as airlines had little or no experience dealing with other forms of payments than the traditional. Suddenly, they had to deal with longer validity, miles expiration and transfer of value. Customers had to deal with vouchers and expiration dates and constantly changing their plans and worrying whether conditions remained the same or whether the airline was still in business. It became very evident that the underlying airline processes and associated technology are very outdated.

Some of the problems related to changes and refunds are quite mind-boggling in 2024 such as:

- Why exchange unused tickets and EMDs?

- Why are there still technical restrictions on the number of exchanges?

- Is the cost for both the service and the auditing of exchanges justifiable?

In this article we want to address some thoughts on modernization and what could be ways to change.

Is part of the answer marketplaces?

Both Flybondi and Royal Air Maroc have introduced marketplace concepts where the passenger can resell tickets. This type of reseller functionality has many benefits, it gives revenue management more visibility and control and an opportunity to resell. From a sustainability angle it makes better sense as we want to fill up the plane rather than having no-shows. In addition, there are many opportunities to turn these concepts into products or loyalty benefits.

Or is the answer to rethink the process itself?

Should change become a product like any other product and be unrelated to the fare itself? Rather than having a complex calculation based on availability and fares shouldn’t the change product be more dynamic? Typically, today change conditions state that “change fee is $$$ and any fare differential”, no wonder the customer is confused.

Or would changes in payment be a way forward?

Another thought is if other payment concepts could simplify servicing? We are seeing an increase of new payment and retailing practices being trialled both in travel as other industries and believe that payment will be one of the drivers that will change the legacy eco-system and support inter-operability for multi-modal travel. The common characteristics, however, will be the need to be flexible to changes after the initial order/reservation has been made.

An example of a retail practice being trialled is ‘pay on delivery’. In the Netherlands a global payment provider and a local supermarket chain have introduced this concept. Simply explained you purchase a product or service, the payment platform collects the money and when the product or service has been delivered the seller, releases the funds from a holding account.

Another possible solution could be ‘Pay When You Fly’ (‘PWYF’), it doesn’t solve all the problems, only some of them, and other technology like blockchain or travel wallets are needed. But the more choice and control the airlines offer to customers, trust and loyalty grows, for example by offering PWYF.

It should be noted that PWYF is not new. It has been around for more than 20 years and is used by several airlines typically for corporate travellers. But the question is can it scale?

Which ones of these problems would go away or are radically changed if we were to apply PWYF and how can it facilitate a transition to Offer/Order?

We do not have to remove tickets and EMDs in our transition to Offer/Order, but PWYF can eliminate some of the pain points in the ongoing process to move to Orders. PWYF would eliminate the exchanges of unused tickets and EMDs. It would simplify IROPS (Irregular Operations) when the airline is not delivering a service ordered. It also saves on handling time of complaints, and it is easier to automate compensation business rules. In addition, we would significantly reduce cost of auditing.

Finally, PWYF would work as an extra incentive for travel retailers (airlines, OTAs, TMCs) to ensure that the promises to their customer are delivered; this will further build trust and loyalty.

Will WEB3 come to the rescue?

WEB3/blockchain technology (like the decentralized Camino Network, the blockchain for the global travel industry) is uniquely suited to support this transformation without even needing payment platforms. By using smart contracts – programs that run on a blockchain and execute agreements without intermediaries – you can program any kind of payment rules and payment flows. This means the settlement can be entirely automated based on some external trigger and both parties involved in the contract have the security that the payment will only happen if certain conditions (coded into the smart contract) are met. Pay when you Fly could easily be implemented via smart contracts that provide escrow and could be triggered to initiate the payment when the flight departed.

Pablo Castillo, CTO of Chain4Travel, the company tasked by the Camino Network Foundation to build the Camino Network: “Pay when you Fly is a great example how using modern technology we can reimagine the payment and booking processes to make it more flexible and adapted to the customer needs by eliminating the complexity of transactions, especially refunds, and create a seamless experience for both airlines and customers. With Camino Network, travel companies can finally leverage web3 technologies to drive digital innovation on a secure, agnostic and scalable operating system for travel.”

Reality check, what’s the impact of implementing Pay when you Fly?

By Paul van Alfen, Travel Payments Strategist at Up in the Air: “a ‘can of worms’ comes to mind when looking into the impact on the current ecosystem of switching from ‘pay at booking’ (or at ticketing a couple of days later) to ‘pay at departure’, at scale. Stakeholders from across the business will see massive changes and an overhaul of systems, processes, and policies, with Finance (cashflow), Revenue Management (forecasting) and Revenue Accounting (reconciliation, reporting, auditing) the most affected. It’s probably fair to say that a new generation of systems will be required, combined with a customer centric mindset and a different (non-pre-payment based) financing model, to make PWYF work at a large scale and across the direct and indirect channels for both corporate and leisure customers.

The main difference with Buy Now Pay Later (‘BNPL’), when it comes to impact, is that BNPL does not affect the timing of payment to the Airline, it’s the full amount at the time of booking and therefore ‘business as usual’.

In summary

We predict that considerable change appears to be inevitable at some point in time to allow flexibility in ordering, changing/servicing, payments, and settlement. Change is driven by the customer and new entrants in the travel ecosystem. Pay when you Fly is only a small part of that change but could lead the way towards much needed simplification.

Article by Ann Cederhall, Travel Technology Strategist and Educator. With contributions from Dirk-Vincent Gemke, Paul van Alfen at Up in the Air and Pablo Castillo at Chain4Travel.

by Jess Brownlow | Jan 10, 2024 | Digital Transformation, On-demand, Payments, Travel Tech

Natalia Lechmanova, Senior Economist, Mastercard Economics Institute and Sheridan Stavac, Global Travel Segment Lead, Mastercard Data & Services joined to discuss the impact of changing consumer spending preferences on the travel industry.

Mapping out the post-pandemic landscape, Natalia explored the evolving behaviour of travellers, looking at when and where they choose to spend money. Sheridan expanded on this, shedding light on how travel companies are adapting to these changing traveller trends. The conversation further touched on driving data-driven decision making and a shifting approach to loyalty.

For more insights from Mastercard on adapting to the evolving travel landscape watch the full interview below.

For more like this see:

by Jess Brownlow | Dec 11, 2023 | Airlines, Digital Transformation, Interviews, On-demand, Payments

Darren Laws, Vice President – Europe Merchant Partnership Development, Visa joined for a concise but comprehensive discussion exploring the shifting landscape of airline payments.

The conversation looked at changing customer expectations, benefits for airlines embracing innovation, and the influence of upcoming technologies on the future of airline payments, with Darren highlighting a series of:

“Small innovative steps that really start to transform the travel experience.”

During the interview, Darren explained how technology can be seamlessly integrated to transform the customer experience, elevate relationships with travellers, and minimise dropouts in the purchase path. Here, the conversation touched on the importance of personalisation and the benefits this harbours for both passengers and airlines.

Watch the full interview below.

For more like this see:

by Jess Brownlow | Nov 20, 2023 | Airlines, Digital Transformation, Payments, Retailing

Alaska Airlines is the first to offer Tap to Pay on iPhone. In partnership with Stripe, a financial infrastructure platform for business, the airline has announced this will now be the primary checkout option for inflight payments.

Charu Jain, Senior Vice President of Innovation and Merchandising said:

“We’re constantly innovating to give our guests the most seamless and caring experience possible. We’re proud to partner with Stripe to be the first airline to bring Apple’s Tap to Pay on iPhone technology to flight.”

Patrick O’Brien, Managing Director of Product Development at Alaska Airlines also explained:

“Instead of navigating complex tech, [our employees] are able to focus on providing the most caring experience for our guests. Transitioning to Tap to Pay on iPhone with the help of Stripe is creating a more seamless payments workflow—with no new devices required and an easy-to-use setup for our crew.”

The innovative tech uses secure NFC technology to take contactless payments from iPhone, Apple Watch, or another compatible smartphone. Passengers can seamlessly complete purchases using their preferred digital wallet, or can select to pay with any contactless debit or credit card.

Alaska will be the first airline to launch this across an entire fleet.

For more like this see:

by Jess Brownlow | Oct 31, 2023 | Airlines, Airports, Digital Transformation, Payments, Travel Tech

Last week, The International Air Transport Association (IATA) announced the results of its 2023 Global Passenger Survey (GPS). The GPS results are based on over 8,000 responses from more than 200 countries and provide valuable insight into what passengers would like from their air travel experience.

Discussing the results of this year’s survey, Nick Careen, IATA’s Senior Vice President for Operations, Safety and Security said:

“Passengers have made it clear: they want to spend less time booking and move through the airport faster. And they are increasingly willing to use biometric data to complete more pre-departure tasks off airport to achieve this.”

The GPS results restate that passengers value convenience. Whether this is for selecting the departing airport, choosing a payment method, or identifying a destination. Once at the airport, passenger expect a similarly streamlined process, and seem comfortable using technology or off-airport processes to facilitate this. Here are some of the key takeaways. You can view the full results here.

- Among seven different payment methods, the most popular was credit / debit card (73 per cent), followed by digital wallet (18 per cent) and bank transfer (18 per cent).

- Digital wallet penetration is most popular in the Asia Pacific region, where 41 per cent of respondents cited this as the preferred option. The next highest market was Europe (15 per cent) followed by Middle East (14 per cent).

- 25 per cent of potential product/services sales during the customer journey could not be eventually completed because of payment issues.

- 87 per cent of travellers indicated they would share their immigration information to speed up the airport arrival process, representing an increase from the 83 per cent reported in 2022.

- Passengers want to complete more processing elements off-airport. 45 per cent of travellers identified immigration as their top pick for off-airport processing.

- Passengers want more flexibility and more control in the baggage process. 67 per cent would be interested in home pick-up and delivery, 77 per cent said they would be likely to check in a bag if they could tag it and check it in before they get to the airport and 87 percent would be willing to check in a bag if they could track it.

- 75 per cent of passengers prefer using biometric data over traditional passports and boarding passes.

What growing trends do you think the 2023 GPS results will show?

For more like this see: